Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last year, China remained "the brightest gem in the crumbling crown of the Brics" (Brazil, Russia, India and China) at a time when other emerging markets were hit by fears of a slowdown in US money-printing, says Kate Morley in the Investors Chronicle.

Despite concerns of a hard landing, the emerging superpower turned in a decent performance in 2013, with UK actively managed China funds delivering an average total return of 18.39%.

Far from having missed the boat, "now is an interesting time" for investors to buy China-focused funds, says Morley. Better economic data, coupled with a delay in the tapering of US quantitative easing, saw Chinese equities bounce back in the third quarter of last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

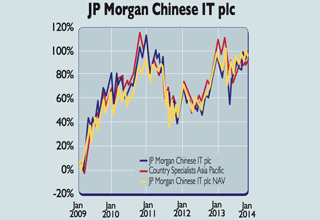

And while the taper is once again rattling investors in emerging markets, upcoming market reforms could mean stocks continue to do well. One way to get exposure is through the JP Morgan Chinese Investment Trust (LSE: JMC), which is run by Howard Wang.

The objective is to deliver long-term capital growth by investing in Greater China' equities firms based in China, Hong Kong and Taiwan. Currently 56% of the trust's holdings are in China, 22% are in Taiwan and 19.6% are in Hong Kong equities.

In terms of sectors, around 38% is invested in financials, while 23% is in IT-related stocks Wang says Chinese iPhone sales have soared, indicating strong consumer demand. Overall, he believes Chinese fundamentals remain strong, while valuations are still low.

| Taiwan Semiconductor | 6.6 |

| Tencent | 5.4 |

| China Construction Bank | 5.0 |

| AIA | 4.6 |

| JF China New Generation Fund | 4.2 |

| Ind & Comm'l Bank of China | 3.8 |

| CNOOC | 3.2 |

| Galaxy Entertainment Group | 2.4 |

| Hutchison Whampoa | 2.2 |

| Cheung Kong | 2.1 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how