Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

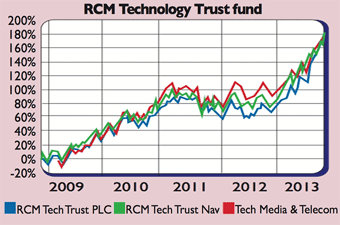

Over the past three years, one of the top-performing technology funds has been the RCM Technology Trust fund (LSE: RTT). It has beaten its benchmark, growing by 62.7% over the past three years, compared with 53.6% for the sector average. It has also beaten the Dow Jones World Technology Index.

The fund is managed by Allianz Global Investors, with experienced manager Walter Price running it from his San Francisco office. This proximity to Silicon Valley enables Price to meet with firms around three times a week, allowing him to gain a "unique insight" into the industry.

His preference is for technology stocks with fast-growing revenues. But while he will tolerate high price/earnings ratios, he insists that a firm must at least be close to turning a profit.After creating a shortlist of around 100 shares, he works with his analysts to find those that offer the most potential.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Instead of companies selling expensive software, they are reinventing themselves as service providers, renting out cloud-based' software on a monthly basis. While this will ultimately bring in more money, it will make short-term cash flow more volatile.

In line with these views, about 20% of the fund is in shares directly related to the mobile internet, such as search engine giant Google, internet radio station Pandora and mobile network specialist Aruba. Cloud computing firms, like Amazon, account for another 20%. He also invests in firms that aim to solve a specific problem, such as electric car firm Tesla.

| Google Inc | 5.5 |

| Facebook Inc | 4.9 |

| Tesla Motors Inc | 4.5 |

| Sunpower Group Ltd | 3.4 |

| Amazon Com Inc | 2.9 |

| Aruba Networks Inc | 2.8 |

| Micron Technology Inc | 2.8 |

| Western Digital Corp | 2.6 |

| Pandora Media Inc | 2.5 |

| Alcatel Lucent | 2.1 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how