Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The high demand for blue-chip dividend-paying stocks in recent years has made it very hard to find companies that can pay out high rates of income without taking on a lot more risk.

But if you are prepared to take a bit of a gamble, then some insurance companies are well worth a look. Speciality insurance companies such as this onecan be quite difficult to understand and this can put people off investing in them.

They provide insurance against catastrophes such as hurricanes and floods. Working out how much to charge customers (the premium) and how much money to set aside to pay any claims is a skilled business. Getting these things right has a big bearing on the size of the dividends they can pay investors.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

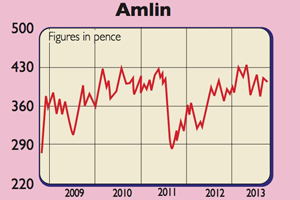

Amlin (LSE: AML)

Amlin has a good record of doing this. The company was able to increase its dividend throughout the financial crisis and has been able to withstand major disasters, such as Hurricane Sandy in 2012, and the low income returns on its investment portfolio.

While competition has increased in some of its insurance markets, it still sees itself as being able to make decent profits and keep on meeting its target return on shareholders' equity of 15%.

Amlin shares are not particularly cheap, trading at 1.5 times book value, but the forecast dividend yield of 6% is attractive and it looks well placed to keep growing.

Amlin's finances are in good shape too as it has £576m more capital than the regulator says it needs. This makes it a decent bet for income seekers.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how