Shares in focus: Should you buy Royal Mail?

From basketcase to well-run business, Royal Mail is finally going private. Should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The former basketcase is now in good shape and is cheap enough for a punt, says Phil Oakley.

Margaret Thatcher considered the sale of the postal service a privatisation too far, but the current government does not share her view. Last week, it announced its intention to sell off a stake in Royal Mail during the next few weeks. The Post Office which runs the post office network is now a separate company, and is not for sale.

Looking at past experience, apart from the disastrous privatisation of Railtrack, most share sales of state-owned businesses to the public have been kind to those who bought in and held for the long term. So should you sign up for Royal Mail shares or stay well clear?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What are you buying?

Given that most of us receive letters and parcels on a regular basis, the Royal Mail should be a fairly easy business to understand. The bulk of its business comes from delivering letters and parcels within the UK. It also has a separate European parcels business that gets most of its income from France, Germany and Italy.

Royal Mail is the biggest parcel delivery company in Britain, handling over a billion parcels a year. It is the only mail company that is obliged to provide a universal delivery service to 29 million addresses in the UK for one price. It costs around £7bn a year to run its delivery network.

The business is primed for sale

During the last few years, the government and the company have gone about making the business a lot more attractive to private investors. And it looks as though it is being sold at a very opportune time.

Not so long ago the Royal Mail was a bit of a basketcase. It was a grossly inefficient business that had failed to adapt to the changing ways in which people communicated with each other. The use of the internet and email has seen the number of letters being posted fall year after year.

The growth of internet retailing, which has driven parcel volumes higher even as letter volumes fall, saw rival parcel providers cherry pick lucrative urban areas to take business away from Royal Mail, which was saddled with the high costs and obligation to deliver everywhere in the UK. Customer service also left a lot to be desired.

So a few years ago the Royal Mail set about putting its house in order. It has spent £2.8bn making the collection, sorting and delivery processes more efficient. As a result it is now spending £500m a year less than it would have been if it hadn't done this.

The government has also been very helpful to the company. Three years ago Royal Mail's pension fund was over £8bn in the red. Now that problem has been shifted over to taxpayers. Elsewhere, the postal regulator, Ofcom, has stated that Royal Mail must be allowed to make a profit on its universal service obligations. It has said that a profit margin of 5%-10% is not unreasonable. As a result, the price of stamps has gone up. Only 5% of Royal Mail's business is now subject to regulation, compared with 60% a few years ago.

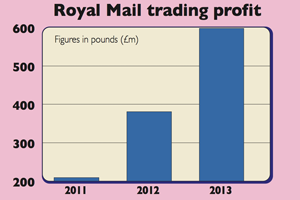

All of this help has seen profits soar in recent years, as you can see from the chart above. A business that was once seeing cash pour out of the door is now seeing lots of it come back in. Debt has dropped and its finances are in very good shape.

Should I sign up for the shares then?

Trading is good at the moment. Parcels which account for nearly half of the company's revenues are booming. Sales were up 13% last year, and 11% during the first quarter of 2013. If Royal Mail is going to grow its profits then its parcels business has to be competitive. If it can look after its customers then the continued growth in internet shopping should see profits go up. Price increases will probably keep profits stable in letters.

One of the key attractions of Royal Mail could be its very strong cash flow, which may allow it to pay some very chunky dividends. Last year it generated £334m of surplus cash, but a look through its accounts suggests that it could do a lot better than this in the years ahead.It spent £665m on investment last year, but this included big redundancy and business transformation costs, which won't be needed every year. Once these have finished it's possible that annual investment spending could be half of last year's level. Cash flow will also get a boost from the lower interest bills that will result from a refinancing of the company's borrowing.

Last week, Royal Mail said that its annual dividend would be the equivalent of £200m had its shares already been listed on the stock exchange. It would also look to grow it from this level. If its cash flow grows it should be able to do this. The unions are set to throw a spanner in the works by calling a strike over pay and pensions in October. But Royal Mail says it has plans in place to deal with it.

That said, I think the shares will be priced to reflect the concerns that some people will have. City analysts expect the business to float with a value of between £2.5bn and £3bn. If this turns out to be true, the shares will look cheap, trading on just 7.6 times last year's fully taxed earnings, even at the top end of that range. A dividend yield of between 6.7% and 8% based on a £200m payout looks tempting too, and would sit nicely in a tax-efficient Isa (individual savings account) or Sipp (self-invested personal pension).

Verdict: risky, but cheap enough to buy

The numbers

| Indicated market value | £2.5bn to £3bn |

| P/e ratio (based on latest profits) | 6.4 to 7.6 times |

| Dividend yield | 6.7% to 8% |

| Dividend cover | Two times |

| Net debt (March 2013) | £906m |

| Net assets (March 2013) | £1,405m |

| Gearing | 64.5% |

| Interest cover | 6.3 times |

How to subscribe for the shares

At least 41% of the shares are expected to be sold, with 10% going to employees. This could go up if demand is high. The timetable has not been released yet, but here's a few things to consider.

- Register your interest with your stockbroker, then apply via them.

- Alternatively, apply direct to the government at www.gov.uk/royalmailshares.

- The minimum subscription is £750.

- The maximum subscription with a debit card is £10,000. There is no limit with cheques.

- You might not get all the shares you want. You may get none at all, depending on demand, although it does seem likely that more shares would be released if this ends up being the case.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Royal Mail’s 7.2% dividend yield is now under threat

Royal Mail’s 7.2% dividend yield is now under threatTips Royal Mail's dividend yield is coming under pressure as costs rise and delivery volumes fall. Profits are under threat, and investors can't take anything for granted, says Rupert Hargreaves.

-

Share tips of the week

Features MoneyWeek’s comprehensive guide to the best of this week’s share tips from the rest of the UK's financial pages.

-

If you’d invested in: Wizz Air and Royal Mail

If you’d invested in: Wizz Air and Royal MailFeatures Wizz Air is the largest low-cost airline in central and eastern Europe – and it is flying high.

-

Company in the news: Royal Mail

Features Phil Oakley explains what the dramatic collapse of competitor City Link means for Royal Mail.

-

Shares in focus: Can Royal Mail deliver profits?

Shares in focus: Can Royal Mail deliver profits?Features Pessimism surrounds the mail service’s prospects. Is it overblown, and should you buy the shares? Phil Oakley investigates.

-

Company in the news: Royal Mail Group

Features Shares in Royal Mail were a steal at their flotation price, but have now fallen back as the company has run into a few problems. Phil Oakley asks if it's time to buy.

-

Company in the news: Royal Mail Group

Features Royal Mail shares looked tempting before the float. But, now the shares have risen in price, is it too late to buy? Phil Oakley reports.

-

Was the Royal Mail sold off too cheaply?

Features Was the British public betrayed by an overzealous government in the Royal Mail sell-off? Emily Hohler reports.