Gamble of the week: A troubled outsourcer

The shares in this public services outsourcer have been hammered by a run-in with the government, says Phil Oakley. A buy for adventurous investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Serco (LSE: SRP) has built a successful business by providing public services across the world, profiting from the huge trend in outsourcing over the last 20 years. By promising to run things like roads, railways, prisons and office blocks better and cheaper than companies and governments can themselves, it claims everyone can win.

Sounds great in theory. But it doesn't always work in practice. Serco is in big trouble with the UK government. In July it was accused of overcharging for an electronic tagging contract, which led to a full-scale review of all its government contracts. Things got worse last week when it was revealed that Serco faces a police investigation for alleged fraud on a £285m prison escorting contract.

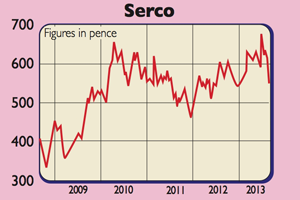

Unsurprisingly, the share price has tanked. Investors are right to worry that Serco's reputation with its biggest customer (the UK government accounts around 25% of annual revenues) may have been damaged beyond repair. This is a useful lesson for all investors it's one thing to weigh up big contract wins and what they mean for future profits, but it's very hard to know if a company is always good at doing its job. When things go badly wrong as they have here the whole company comes under the spotlight. So should you avoid Serco? Or is this an unfortunate blip?

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While there are legitimate concerns that governments around the world will look to save money and award less generous contracts in future, Serco's £18.5bn order book means it has a good idea of how much money it will make in the next few years. Throw in the fact that it has a well-diversified portfolio of contracts across the world, and a sound financial position, and there could be a decent investment opportunity here. Just be aware that Serco's problems may mean that you are catching a falling knife. It's a gamble for adventurous investors.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.