How our tips have fared: Stobart and Aga Rangemaster

Phil Oakley looks back at two of his riskier share tips to see how they have got on.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

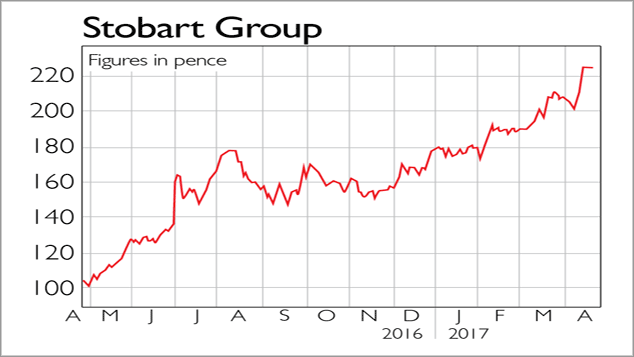

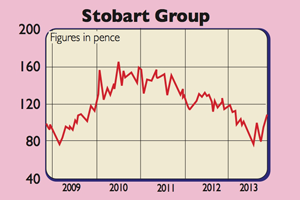

Stobart Group (LSE: STOB)

The company is best known for its distinctive trucks that plough up and down Britain's motorways. The trucking company is a reasonable business that manages to eke out a reasonable living in very tough markets. A legacy property business is gradually being sold off to pay down debt. However, it is the potential of Stobart's ownership of Southend airport that keeps me interested in the shares. I think that this asset has huge potential to make lots of money for its shareholders, as it has a lot of good things going for it.

The main terminal extension is nearly finished and the airport has excellent car parking facilities and decent rail links. It has also just won the Which? airport of the year award for its high levels of customer satisfaction. EasyJet, the airport's main customer, is doing well. It has just added a fourth aircraft to the airport while announcing some new destinations. This should see passenger numbers at the airport grow by 20%.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Given that Stobart has put a lot of money into the airport, it looks well placed to start getting a growing stream of cash flow back. Regional airports have proven to be decent investments in the recent past and have realised very high prices. Growing traffic at Southend could see this reflected in Stobart's share price in the years ahead. The 6p dividend looks like it will be maintained for the time being, meaning that investors are being paid to wait.

Verdict: keep buying at 111p

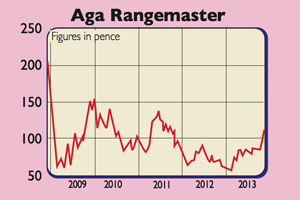

Aga Rangemaster (LSE: AGA)

a very risky buy last December

So it's no surprise to hear that Aga orders were up by 8% during the first six months of 2013, while demand for Rangemasters which have been popular in new-build houses in the past is starting to pick up after a slow start. When Help to Buy is extended to the whole housing market next April, I expect Aga could be in for a further sales boost.

The company is now pinning its hopes on its new electric Agas and wants to see existing customers trade up to better models. If they do, Aga's profits could soar, given that it has very high fixed costs (or operational gearing), which would see a large chunk of any extra sales from new cookers turn into profits.

Aga's pension fund liabilities are still an issue. The fund will get its hands on any extra cash before shareholders do. But higher bond yields in recent months have meant the problem isn't getting any worse.

With the housing market steaming ahead, Aga shares may have further to run.

Verdict: keep buying at 113p

Stay up to date with MoneyWeek:Follow us onTwitter,FacebookandGoogle+

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge