Shares in focus: Is BP's well running dry?

BP is a great money-spinner, but the oil giant comes with plenty of risk. Should you buy in? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

BP faces big problems, but it will continue to spin off cash for investors, says Phil Oakley.

Not so long ago, BP was seen as a share you could buy and almost forget about. It had become so good at delivering the goods that it warranted a place in most investors' portfolios. By buying up companies such as Burmah Castrol, Amoco and Arco, it turned itself into one of the big beasts of the world's oil and gas companies a so-called oil major'.

As well as making itself bigger, BP seemed to be very good at getting oil and gas out of the ground and making lots of money from it. It had enviable control of costs and delivered impressive returns on the money it had invested in the business that others struggled to match.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

All that changed in 2010 when an explosion on one of its oil rigs in the Gulf of Mexico led to a disastrous oil spill. The cost of the clean-up and the overall compensation bill is still not entirely clear, but BP's reputation as a competent oil and gas operator has yet to recover.

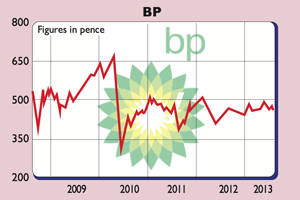

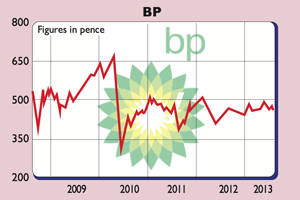

Following the disaster, BP's share price halved almost overnight. It has bounced back from the lows, but for the last two and a half years the shares have done next to nothing as investors worry about the long-term impact of the disaster and BP's ability to make more money over the long haul. So will the firm be consigned to the land of corporate dinosaurs? Or does the lacklustre share price provide an opportunity for patient investors?

What the future holds

Let's be clear: there is a lot to worry about with BP. One of the most obvious questions is the issue of how much the final bill to sort out the Gulf of Mexico mess will turn out to be. So far it has cost $42.4bn, but a $20bn trust fund that was set up to pay out compensation claims has almost run out and will need topping up. On top of that, it looks like it will be tough for BP to win fresh business in the US for some time.

Another bigger picture' issue is the question mark hanging over the ability of BP and other big oil companies to get decent returns on the money they spend. They are shelling out lots of money to look for oil and gas and to get it out of the ground, but are struggling to actually produce more. The big concern is that returns on this investment will fall and will make companies such as BP less rather than more valuable.

Some professional investors are so concerned about this issue that they've decided companies like BP are not worth bothering with. There are plenty of smaller oil and gas companies out there that are growing very fast and tapping new sources of energy such as shale gas. These could be a better long-term bet than the sluggish industry giants like BP.

But I'm not sure this really matters that much. It should be quite obvious that big companies can't grow as fast as smaller ones that's just the law of big numbers at work. In fact, big, mature companies probably shouldn't be spending lots of time and money on getting bigger. They should focus on generating lots of surplus (or free) cash flow and pay most of it out to their shareholders in dividends.

What about the dividends?

So, what I think people should concentrate on is BP's dividend, and its ability to maintain and grow it. At the moment, BP shares offer a prospective dividend yield of 5.3%, which is more than twice covered by expected profits. Growing the amount of free cash flow and the dividends payable to shareholders is at the heart of BP's strategy.

By 2014 it expects to have $31bn of operating cash flow 50% higher than what it was making in 2011 while spending $24bn-$27bn. With $3bn of asset sales pencilled in for the next few years, BP could have free cash flow of $7bn-$10bn a year and will look to grow that number. If it can do this, then buying BP now for a decent yield and dividend growth might not be a bad idea.

Where will the cash flow come from?

BP still has a solid production business, underpinned by projects in places like the Gulf of Mexico, Azerbaijan, Georgia, Angola and the North Sea, which should help production grow. It also has potentially good exploration assets in Brazil, China, India and Norway, where it has recently made a decent gas discovery. Then there is BP's investment in Russia.

BP sold its 50% stake in TNK-BP to Rosneft in return for cash and a 19.75% stake in the Russian oil giant. Many think this was a bad deal for BP as it is currently not getting anywhere near as much money as from its TNK-BP venture, and investing in Russia remains a political risk.

That said, Rosneft should start paying BP more money as it becomes more profitable. There are cost savings to be had from integrating TNK-BP, while Rosneft is selling more oil and gas to China.

This is all well and good but could costs in the Gulf of Mexico soar and blow a hole in the company's finances? This looks unlikely. BP's balance sheet seems to be in very good shape. Its gearing levels (net debt as a percentage of equity) are very low at just 14% while interest payments are currently covered 46 times by profits. BP looks like it could cope with most things that life can throw at it. With the various problems hanging over it, it is a risky share but it's one that could give you a decent source of income at a good price, while City fund managers ignore it.

Verdict: buy for dividends

BP (LSE: BP)

Share price: 440pMarket cap: £84.2bnNet assets (June 2013): $130.1bnNet debt (June 2013): $18.2bnP/e (current year estimate): 8.6 timesYield (prospective): 5.3%Interest cover: 46 times

What the analysts sayHold: 18Sell: 4Target price: 493p

Directors' shareholdings

R Dudley (CEO): 346,008B Gilvary (FD): 413,221C Svanberg (chair): 1,013,353

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how