Gamble of the week: Turnaround dry-cleaners

This struggling high-street dry-cleaners has had the turnaround treatment. That makes the shares a speculative buy, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Five years ago, Johnson Service Group (LSE: JSG) almost went bust. Its dry-cleaning business suffered during the recession as consumers had their suits and dresses cleaned less often. What's more, the high street's demise as a shopping destination hasn't helped matters either. This made it hard for the company to pay the interest bills on its debt.

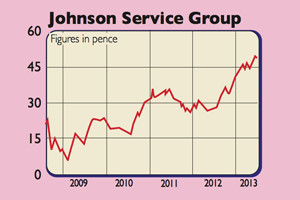

Turnaround specialist John Talbot was brought in to sort things out. He has done a very good job. Investors have put up more money and over 100 unprofitable dry-cleaning shops have been closed. Last week, the company sold its facilities-management business and its portfolio of private finance initiative (PFI) contracts. Most of the debt has gone and the shares have become more popular, with the share price up more than 70% on this time last year. But I think there's more to come.

Johnson Service makes most of its money from renting out workplace clothing (known as textile rental) and providing dust mats, industrial wipes and washroom hand towels. Trading under Johnsons Apparelmaster, it has 44,000 customers and provides clothing to over a million industrial and food-production workers every week. It also rents out premium linen to hotels, catering and hospitality companies.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The facilities management business went for less than net asset value, but frees up firepower to expand the workwear unit in Britain and abroad. If the British economy is recovering, it could do well. Dry cleaning is looking up too. It can be hard to make money in this business margins are wafer thin. But underlying sales are rising off the back of environmentally friendly cleaning services.

Selling the profitable PFI business for a low price will dent profit forecasts, but analysts still expect underlying profits growth of 8%. The 2.5% yield is not stellar, but the firm pays out only a quarter of its profits to shareholders so this has scope to increase.

Trading on just over ten times 2013 forecast profits with reasonable growth, the shares still look good value. It would also not surprise me if its workwear business caught the eye of some support services firms looking to expand their range of services.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.