Shares in focus: Is Rotork Britain’s greatest company?

Rotork may not be a household name, but it is one of Britain's most successful businesses. So should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This flow-control equipment maker can't put a foot wrong, but is the price right, asks Phil Oakley.

Ask people to name a great British company and the chances are you'll hear the likes of Vodafone, GlaxoSmithKline and HSBC mentioned. There's no doubt that these firms did something right in the past as they're among Britain's biggest, most valuable firms. But, in investing, being biggest doesn't always equate to being great today. That's because big firms usually can't grow much further. Many are just managing their own decline.

Step forward, Rotork (LSE: ROR). This firm is not really well known by the wider public. The Bath-based company is the world's leading designer and maker of flow-control equipment. It sells actuators, which control the flow of gases and liquids in thousands of applications across the world. Without getting into the technical details, actuators are all around us and life would be a lot more complicated without them. And measured against criteria such as profit growth, return on investment and cash flow, Rotork is a strong candidate to be Britain's greatest company.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

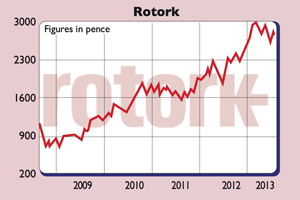

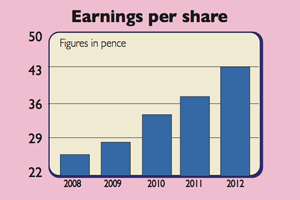

The stock market certainly loves it. Since 2003 profits have grown by nearly 20% a year, while the share price has increased almost tenfold. It was one of the few industrial firms to keep profits growing during the financial crisis. But Rotork is now worth £2.5bn and, after a stellar run, it seems reasonable to ask whether it can keep delivering for investors.

What to do with the shares now

However, just because an area is growing, it doesn't always mean there's lots of money to be made from it, of course. Airlines and the internet are ample evidence of this. Fortunately for Rotork, it operates in less savage markets. Like any successful business, it thrives because it is exceptionally good at giving its customers what they want. It has a great track record of producing innovative new products that do a better job for customers, while providing great service. Also, competing with Rotork is not easy.

Actuators are critical components, so they need certification before they can be used. This acts as a barrier to entry to new competitors, and is something every investor should look for in a business.

Then there is Rotork's attractive business model. Around 90% of its manufacturing requirements are outsourced to third parties. Components are bought in ready made then put together when an order is received. This means that Rotork does not have a lot of money tied up in expensive plants and equipment, which can be a drag on profits, especially when business is tough.

With all these things in its favour, it should come as no surprise that Rotork's financial performance is exceptional too. Return on capital employed (ROCE) is arguably the best way to identify how good a business is. It measures how much profit a company makes as a percentage of the money that has been invested in the business.

In 2012 this number for Rotork was a staggering 62% and has been over 100% in the past. The company also has a clean set of accounts. For example, profits convert into cash flow, which is always a good sign, while the company has net cash on its balance sheet and very little debt.

What does the future hold?

That said, the company is steadily increasing the number of actuators on long-term maintenance contracts. My real gripe is the price of the shares. Trading at over 23 times forecast earnings, they are more expensive than most other industrial companies out there. Pumps maker Weir Group trades on just 15 times earnings, for example. Of course, quality companies should be expensive. However, Rotork's shares have become progressively more so during the last 18 months. At the bottom of the market in 2009 you could have picked them up for around 12 times earnings, even though profits were still growing.

Rotork is a wonderful company, which is likely to be making a lot more money in ten years' time than it is now. Long-term investors could still do well buying now. But I'd be inclined to wait for a dip in the market before plunging in. Overall, it's one for the watch list.

Verdict: too expensive for now

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how