Shares in focus: Will Reckitt Benckiser's shares keep rising?

Pharma giant Reckitt Benckiser has been a great investment, but can it keep delivering the goods? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Are Reckitt Benckiser's shares likely to keep rising? Phil Oakley investigates.

The chances are that you will have one or more Reckitt Benckiser (LSE: RB) products in your house at the moment products such as Dettol,Vanish, Strepsils, Nurofen and Finish, to name but a few. Dettol antiseptic and Finish dishwashing products are world leaders, as is the Veet hair removal brand. These brands are very popular with households and have been a firm favourite with investors for many years now.

Reckitt Benckiser is a sought-after company because of its impressive portfolio of brands. These brands are bought time and time again by households across the world and give the company a predictable income stream that investors crave. On top of this, Reckitt Benckiser has been able to keep innovating and producing new products that people keep buying. Despite the existence of cheap, private-label substitutes and competition from other brands, Reckitt Benckiser has managed to build a rock-solid business.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

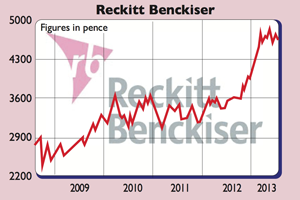

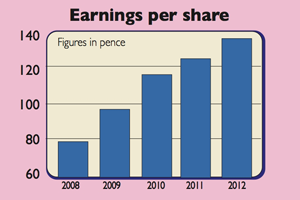

In financial jargon it has built an economic moat' that allows it to keep earning excellent returns for its shareholders. Return on capital employed (ROCE) of 23.4% in 2012 bears this out, while it has also been able to generate lots of free cash flow to keep the dividends growing while buying back shares as well. During the last ten years dividends per share have increased at an average annual rate of 18% and the share price has gone up fourfold.

What to do with the shares now

This is not the sort of company you can expect to pick up cheaply, even when the stockmarket is in the doldrums. You have to pay up for quality.

But the shares currently trade on over 17 times forecast earnings for 2013 and offer a 3% forecast dividend yield. City analysts currently expect virtually no earnings growth in 2013 and 4% growth in 2014. If their expectations are met, then Reckitt Benckiser shares look quite expensive.

This conclusion may be missing the point, though. Profit growth is being held back by the declining profits of Suboxone tablets Reckitt Benckiser's treatment for heroin dependence which has come off patent and is losing out to cheaper generic competition (Suboxone film is under patent until 2020). This masks the fact that the underlying health and hygiene business is still doing well and this is where the bulk of Reckitt Benckiser's value rests.

So, can the company's household products grow at a fast enough rate to justify the current share price? On the current evidence, it looks like it is doing a reasonable job. During the first six months of 2013, like-for-like sales increased by 6%. This is a creditable performance, given that a large chunk of sales comes from difficult European and North American markets. What's also encouraging is that profit margins went up too as the company got out of less profitable private-label markets and became more efficient.

Is a merger on the cards?

This means selling more Dettol, Veet and Finish in countries such as India, Brazil and China. Reckitt Benckiser wants emerging markets to make up half of its sales by 2015 compared with around 30% now. However, while the firm is seeing good growth at the moment, it will need to keep the momentum going. Another option is for Reckitt Benckiser to put its hand in its pocket and splash out on buying in some good brands.

The company's financial position is very strong just now and it could comfortably take on more debt without worrying too much. Three years ago, it spent £2.5bn on the maker of Durex condoms and Scholl footcare products, while it recently bought American vitamin company Schiff and a Chinese maker of sore-throat remedies. These purchases have plenty of potential to help the company's profits grow in the years ahead.

There's also the possibility that Reckitt Benckiser could be part of a household goods mega-merger either as the buyer or as the target. Despite the attractions to customers of its reliable, well-known brands, getting more people to buy more products year after year is no easy task.

This means that getting together with another big global household goods firm, such as Unilever or Colgate Palmolive, could see it make some big gains in terms of advertising and buying power, which could make sense for shareholders at the right price.

The company's declining pharmaceutical business is the only major negative to the shares at the moment. But otherwise Reckitt Benckiser is still an excellent business that would be at home in any investor's portfolio.

The only problem is the current share-price valuation. It's simply too high for me to think about buying the shares. I'd like to see low to mid-teens profit growth to enable me to think that I was getting a good deal. But I certainly wouldn't sell the shares if I already owned them.

Verdict: hold

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club