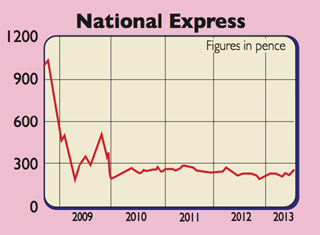

How our tips have fared: National Express

Phil Oakley takes another look at National Express to see how the bus company has got on since he tipped it last year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In March last year, I tipped National Express at 237p. You'd have been better off sticking your money in a FTSE 100 tracker.But last week's half-year results suggest the company is doing a good job of turning itself around.

Profiting from buses, coaches and trains isn't easy these days. These businesses have always relied on some government subsidies to pay for things like bus passes for pensioners and fuel duty rebates to make profits. With governments looking to save cash, these subsidies have been cut. High oil prices and weak economies don't help either.

Yet National Express's profits are holding up well even in Spain, where having a coach business which offers affordable travel has proved helpful. One key draw of investing in this company is that customer demand and revenues at several of its businesses are quite stable: commuters on trains and buses, and students going to school, for example.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, coach travel is thriving, as people look to shift from trains and planes as a way of saving money. This makes National Express a relatively low-risk business, providing it is run well.

I particularly like the focus on generating more cash and improving the returns on capital employed (ROCE). National Express expects to generate at least £150m of free cash flow, which gives the shares a free cash flow yield of 11.5%. The school bus business in America should be able to improve its ROCE and squeeze out more cash too.

The areas where it is looking to grow buses in America and trains and coaches in Germany don't need much investment, as the buses and trains are paid for by the customer.

This should mean that National Express is capable of generating more cash and using it to repay debt and grow its dividend. If it can do this, it will create a more valuable business for shareholders.

A big business in Spain means that there's still some risks to the profit outlook, but this looks factored into the share price. Trading on 11.5 times 2013 earnings with a secure 4% dividend yield and decent cash flow, the shares are still worth buying.

Verdict: keep on buying

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.