How two of our tips have fared

Phil Oakley re-examines two of his share tips from last year to see how they have got on.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Phil Oakley re-examines two of his share tips from last year to see how they have got on.

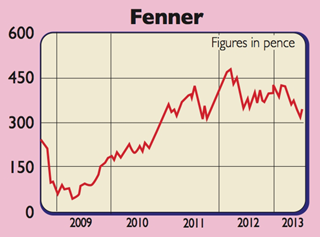

Fenner (LSE: FENR)

Despite having some good businesses, Fenner's profits are still heavily influenced by what's going on in the global mining industry. It is the world leader in supplying heavy duty conveyor belts to mining firms and has been hit by soft trading in its key Australian and American markets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Moreover, a slowdown in the Chinese economy last year saw less demand for Australian coal and iron ore. The US shale-gas boom weakened demand for coal there. It's no surprise that Fenner's customers bought fewer belts and profits fell heavily.

I continue to like Fenner's Advanced Engineered Products (AEP) business. It specialises in niche, problem solving products that are crucial to their customers in areas such as oil exploration, energy, medical devices, diesel engines and package handling. Here profits are more resilient as there is less competition and good growth prospects.

With a recovering mining sector, high oil prices and good prospects for AEP, Fenner's profits should start to grow again next year. On that assumption, the shares look cheap trading on 10.7 times August 2014 earnings, while offering a 3.5% yield with a growing dividend.

Verdict: buy

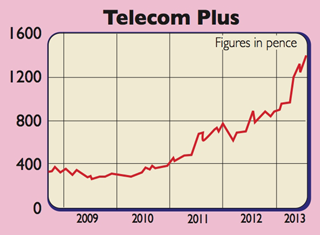

Telecom Plus (LSE: TEP)

Things get better still if the customer becomes a company distributor. This allows them to be paid commission for every new customer they sign up. The rewards can be big. If they become a distributor and one of their customers then becomes a distributor, they get some of their commission as well. It's not really surprising that there's a growing number of people making a good living out of this. It's also great for Telecom Plus, as it allows them to win customers cheaply and boost their profits.

Telecom Plus is still doing very well. Customer numbers are growing at 20% per year, while existing customers are buying more products. Profits are expected to grow by 15%-20% over the next couple of years. But the shares now look too expensive. When I tipped them at 707p, they were trading on just under 20 times earnings but offered a nice yield of 4.2%, as a large chunk of the profits gets paid out every year. Now they trade on nearly 30 times earnings with a yield of 2.7%. As good a business as Telecom Plus is, it's time to take profits.

Verdict: take profits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how