Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In Friday's edition of MoneyWeek, our resident share tipster Paul Hill declared: Gold is in a bubble. He's not the first market commentator to make this judgement, and I doubt he'll be the last.

Now, to my mind, Paul's analysis of individual companies is second to none, but this is a major macro investment call and a crucial one to get right.

Is gold in a bubble?

Is he right? Is gold in a bubble? Let's take a look

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A classic sign of a bubble is that supply far outweighs demand, yet prices keep rising. This was apparent in the US housing market in 2006, for example, where they had huge inventory overhang and yet the market continued on up, up and up. So does this apply to gold?

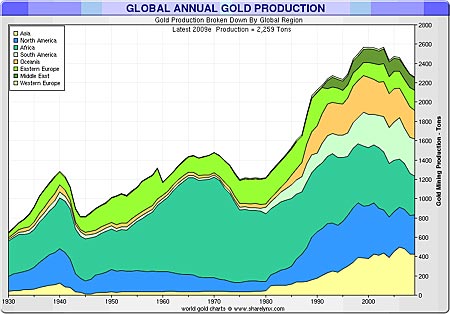

Our first chart (thanks as ever to Nick Laird at sharelynx.com) shows global gold production. Since hitting a peak in the early '00s, it is in a downtrend. Major 'elephant' gold discoveries are not happening at the rate they used to.

Production is falling, but demand thanks particularly to exchange-traded funds is rising. So we don't need to worry about a supply overhang.

But of course, there's a lot more to a market than a supply-demand imbalance. Perception and psychology are everything.

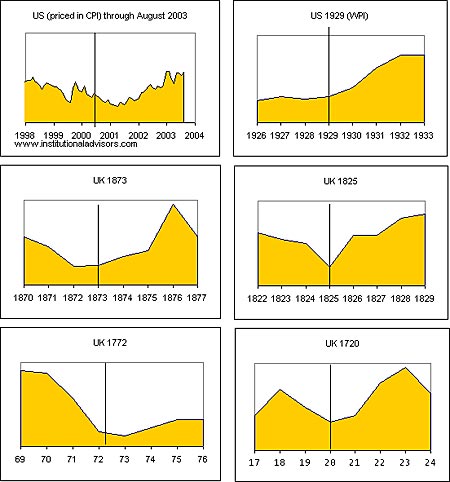

When making a macro investment decision it is vital to understand the economic environment we are in. Currently, we are in a post-credit bubble contraction. Bob Hoye of Institutional Advisors has looked back at previous contractions over the past three hundred years none of which were on the same magnitude as this one and produced the following charts. It shows the price of gold against a basket of senior currencies and commodities - in other words, gold versus everything else - during each crash.

There's a clear pattern here gold falls with the crash, and then rises in the post-bubble contraction. Why should this time be any different?

Gold has entered the mainstream

However, that's not to say that there aren't worrying signs.

For example, the notion that gold is in some sort of 'stealth bull market' that nobody knows about, and that gold ownership is some kind of secret club with only a few enlightened members, is certainly not true anymore. The cat is out of the bag. People know all about gold.

As I noted recently, I heard an advert to buy physical gold on commercial radio. Paul Hill also rightly notes that the vending machines selling physical gold in Germany are a worrying sign. A diehard goldbug might counter this by saying that gold is money, so how is a vending machine selling physical gold any different from a cash point? But the fact remains gold has entered the mainstream.

Enjoying this article? Sign up for our free daily email, Money Morning, to receive intelligent investment advice every weekday. Sign up to Money Morning.

Yet if I look at the circle of my friends, it's still the case that very few own gold. A few of them know about it. A couple of them might have bought some kind of gold exchange-traded fund (ETF), but actual physical ownership? Very few. If I say 'gold', I still get that look that suggests I'm some kind of weirdo.

Paul echoed the frustration of many when he observed that last year we only just avoided financial Armageddon and yet gold failed to consolidate above $1,000 an ounce. It's a good point it's supposed to go to the moon in times of panic. But as the charts above suggest, gold was in fact doing what it always does. It fell with the crash. It is the post-crash, post-bubble environment we need to have our eye on.

During last autumn's financial panic, the gold price fell to just below $700 an ounce from a high of $1,000 some six months earlier. Yet there was a shortage of physical gold. Refineries had sold out and coin dealers reported unprecedented demand. Baird - our largest bullion dealer - even stopped selling coins at one stage.

Why then did gold fall, if there was such physical demand? Because the scale of deleveraging in the paper markets dwarfed anything that could possibly happen in the physical markets. In turn, that means there's no reason to expect falling demand for gold jewellery during the Indian wedding season to hurt the price of gold it's the paper markets that count.

What does this all mean for gold investments?

Where I do agree with Paul is that Randgold Resources (LSE: RRS)looks like a sell here. It's a good company, but it is fully valued and there are perhaps better opportunities out there. And if the current stock market sell-off continues, then gold and gold stocks will sell off too. If you were smart enough to get in late last year, you would have multiplied your investment and it makes sense to take some profits.

But the bull market for gold stocks is far from over and we should have at least a couple of years more fun. If the price of gold rises against everything else from currencies to commodities - in a post-bubble environment, then that means lower operating costs and greater profits for miners. Further down the road, it also means that higher valuations will be placed even on unexplored ore bodies.

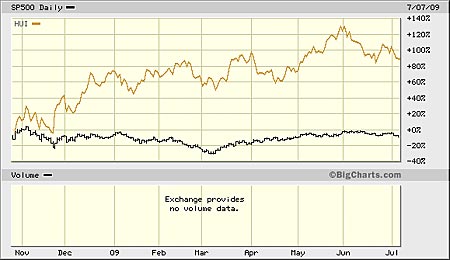

Looking at the bigger picture, over the next year or three I am looking for much higher gold prices. I expect gold to rise and sell off with overall stock market, but you will see significant outperformance by gold stocks when the market rises, just as we have seen these past nine months. The next chart shows the outperformance of gold stocks over the S&P 500 since the October 2008 low.

However, in the short-term, I am looking for a tradeable summer low sometime this July or August for a seasonal rally into the autumn and, hopefully, beyond. For the moment, however, gold is range-bound between about $915 and $950, just as it was range-bound in spring/early summer 2005 and 2006, before launching off on a huge six-month move. Make sure you're on board for the next big one.

Our recommended article for today

One small-cap tech company to watch

The world of touch-screen technology is changing, used in everything from banking to vending machines and retail displays. Tom Bulford investigates the market, and tips a world leader in this fast-growing sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

What are Avios-only flights and who is eligible?

What are Avios-only flights and who is eligible?Avios-only flights have proved incredibly popular since launching in 2023. We explain what they are, how they work and who qualifies