Gamble of the week: a cheap logistics firm

This British logistics firm might be a better business than its share price suggests, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Everyone wants to buy cheap stocks. But the market usually gets it right. You might think you've found a cheap stock, but you then find there's a terrible business behind it and it turns out that cheap' wasn't cheap enough. Yet, sometimes bad firms make good investments. Because they're unloved, they trade on low valuations. That means they can deliver high returns if things don't turn out as badly as the market fears.

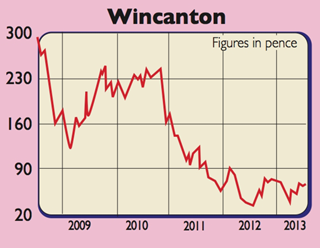

I'm wondering if Wincanton (LSE:WIN) , a British logistics firm, is one of these stocks. At 66p it trades on a forward price/earnings multiple of 4.3 times. That's low, no doubt about it. But is it too low?

The latest annual report reveals some of the problems. Getting goods from A to B is cut-throat. Two-thirds of Wincanton's contract logistics business comes from the retail and consumer goods sectors, which are struggling in a weak economy. This can mean less stuff being transported, so less money for Wincanton. Other customers want to save money and are negotiating on price.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So what could make the shares a buy? Rising bond yields could cut the pension deficit. An interest-rate swap would protect part of the interest bill, but each 0.1% change in bond yields changes the pension liability by £16m. Falling bond yields have seen liabilities rise by more than the value of assets. Rising bond yields could see this process reverse. With the deficit almost twice its equity valuation, improvements could boost the share price.

Verdict: cheap enough for a gamble

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King