Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

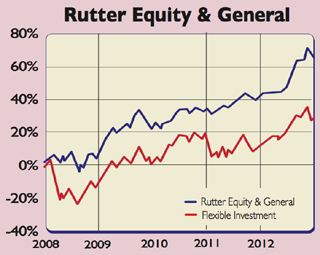

For most fund managers, the market's recent tumbles won't have been fun. Yet for Alex Grispos, manager of the Ruffer Equity & General Fund, they are ideal. Grispos is a "value investor, looking to buy out-of-favour stocks that he believes are undervalued", says Joshua Ausden on FE Trustnet. That means that this year's combination of a bull market interspersed with sharp sell-offs have been ideal. He's taken advantage of rising markets to build up a cash reserve that can be used when the economic environment worsens.

This year's bull market provided Grispos with few opportunities. "Economic activity is improving, but the irony is that it is most difficult to find new ideas at current prices," Grispos said in a recent note. "Few sectors in the market are undervalued and/or out of favour." This is changing and there are bargains around, says Ausden, so "buying the fund now seems like a particularly good idea".

Grispos has delivered before. The fund, which charges an annual fee of 1.2%-1.5%, has returned 64.26% since he took over in 2007, outperforming its sector average of 17.82%. Grispos protected his fund's value during the downturns while many others tanked. It is invested almost entirely in developed markets, with 34% of holdings in America and 17% in Britain. Tesco, which has lost UK market share, is a top ten holding. Another contrarian choice is Fidelity China Special Situations, Anthony Bolton's poorly performing China fund.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Contact: 020-7963 8100.

Ruffer Equity & General top ten holdings

| IBM | 4.3% |

| General Dynamics | 2.7% |

| JPMorgan Chase | 2.1% |

| Johnson & Johnson | 2.1% |

| BP | 2.0% |

| Fidelity China Special Situations | 2.0% |

| 1.9% | |

| Groupe Bruxelles Lambert | 1.9% |

| Tesco | 1.9% |

| Aegean Airlines | 1.9% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Properties for sale with beautiful kitchens

Properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence