Shares in focus: An impressive metamorphosis

Better known for its newspaper business, John Menzies has moved into supplying airlines. Will it pay off, and should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

John Menzies' move from newspapers into aeroplanes is worth backing, says Phil Oakley.

John Menzies opened its first book stall in Edinburgh in 1833. Over the next 165 years, it established itself as a prominent bookseller, newsagent and stationer across Britain, before switching to focus on its logistics business. Instead of selling newspapers and magazines, it became a middleman, collecting them from the publisher, then distributing to retailers.

For many years this has been a tough business with wafer-thin profit margins. Newspaper and magazine circulation has been steadily falling as more people get their media over the internet. Menzies' profits have held up as it gets paid on a percentage of cover prices, and publishers have been putting these up year after year. Menzies has also cut costs as the volume of work has gone down.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Sooner or later, of course, you run out of costs to cut. But the firm hasn't been standing still. It saw the writing on the wall for the news business and in the early 1990s it branched into aviation services. Despite what you might think, this business has a lot in common with news distribution: demanding customers who need vital tasks to be performed efficiently and on time. Menzies is now the second-biggest independent player in the aircraft ground handling market.

Should you buy the shares?

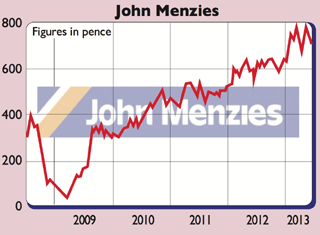

Yet despite these headwinds, Menzies' shareholders have done quite well. The share price collapsed during the 2008-2009 financial crisis, but it has recovered nicely since then. Indeed, despite the challenging economics of news distribution, Menzies has done a good job of maintaining its profits. It will cut a further £10m in costs over the next three years.

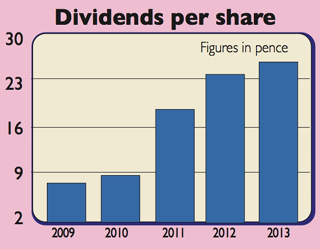

Menzies has also managed to sign new deals with News International and Marketforce, the second biggest distributor of magazines in Britain. The company is diversifying into new areas and, crucially, the business doesn't need to spend much moneyto stay afloat, so it is a great source of surplus cash that can be paid out to shareholders.

The growth potential lies with aviation. Airline customers struggle to make money consistently, and the business is very sensitive to what's going on in the world economy. But for good companies such as Menzies, there is scope to grow. Having got rid of some loss-making contracts in its cargo-handling business, it can focus on the better prospects offered by passenger airlines.

Areas such as check-in and boarding, baggage handling and aircraft cleaning may be unglamorous, but they are also critical. Activity here is measured in the number of aircraft turns'. Menzies expects the available market to grow from 31 million in 2012 to 46 million in 2020. Three-quarters of this market is still in the hands of the airlines who do their own handling. Increased outsourcing should give Menzies a good chance of growing. It wants to double its share of the market from 3% to 6%.

Menzies' strategy is focused on 50 airports across the world where it thinks it can make good money. I expect it to keep winning new contracts and retaining business with its existing customers.It also has a very strong financial position, which may allow it to buy capacity at target locations. By partnering with the right airlines at the right airports, Menzies could see strong profits growth over the next decade.

Menzies is a cash-generative company offering steady profits and dividend growth. At about 700p, it trades on just over ten times this year's expected earnings, with a prospective yield of 3.7%. It's still worth climbing on board.

Verdict: buy

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.