What happens when the money taps are turned off?

We all know quantitative easing has to end some day. When it does, you want to be well prepared, says James Ferguson. Here, he reveals what you should do.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We all know quantitative easing has to end some day. When it does, you want to be well prepared. James Ferguson tells you how.

If only US Federal Reserve chairman Ben Bernanke hadn't opened his mouth. Everyone knew that quantitative easing (QE) would have to end one day but investors had convinced themselves that, in the meantime, they could keep partying.

When Bernanke told US politicians on 22 May that the Fed might have to "taper" off QE, he put an end to all that. In doing so he spooked the largest, most liquid market in the world: the US Treasury market. And when you spook Treasuries, you spook every other market in the world. Bonds are down. Stocks are down. Commodities are down. Where does one hide when everything is falling?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is the commonly held view of what happened to markets this month. After all, at $45bn a month, the Fed has been soaking up around 80% of the projected 2013 US government deficit of $643bn. If the Fed stops funding government spending, who'll take up the slack? No wonder Treasuries and everything else dived when Bernanke revealed the Fed might not be buying for much longer. Yet, if you look closer, virtually none of this stands up to scrutiny.

Firstly, the US Treasury market had been in virtual free-fall for at least three weeks before the Fed chairman uttered a word. Meanwhile, the US dollar has been on a steady uptrend since February. And the ten-year Treasury break-even' which reveals what markets expect the future rate of inflation to be began selling off as far back as January.

In fact, the seeds were sown in mid-December, with the launch of QE3, when the Fed decided to start buying $45bn of Treasuries per month. The yield on the US ten-year government bond hit a record low of 1.4% in July 2012. In December, the day before the Fed announced QE3, it was still only 1.65% (see below). But it's been trending higher ever since.

On 20 May, the day before Bernanke gave testimony to Congress, the yield had already hit 2%. Today it is 2.6%. The fact is, the consensus view on QE and how it affects the bond market is wrong. Here's why.

QE is bad for bonds

Let's have a quick reminder of what QE was for. After the financial crisis, banks stopped lending because they were broke. As a result, the money supply was shrinking, and so was the economy. That's why central banks took the risk of printing money in the first place. Yes, QE is very inflationary, as its critics maintain. But what they often fail to understand is just how deflationary this backdrop was. So the money-printing of QE simply cancelled out the destruction of the money supply by the banks. For example, in Britain between 2009 and 2011, you got dead calm no net money supply growth and very little inflation, beyond what was imported from abroad.

Inflation is bad for bonds (because they pay a fixed income), and so tends to make bond yields rise (as prices fall). In fact, bond yields in recent years have fallen fastest in the absence of QE. That's when economies face the prospect of a proper deflationary contraction in the broad money supply. Even although QE involves central banks buying bonds (to artificially pump up the money supply), their actions make everyone else in the market want to sell. As the chart below flags up, bond yields have generally been flat or rising during periods of QE. So it would be a huge surprise if US Treasury yields had spiked now because the Fed had decided to taper, let alone stop, QE.

If anything, it's QE3 itself that did the damage to bonds. Why? Because it broke the rules. For the first time anywhere in the world during this crisis, QE (which adds to the money supply) was co-existing with a normally functioning banking system (which adds to the money supply via new lending). Banks have been tentatively growing their loan books in America for a couple of years now.

So instead of neutralising each other, monetary policy and the US banking system are both now in inflationary mode. There isn't a bond market in the world that would take that lying down. So it's no surprise that Treasury markets have been trending higher since Bernanke announced QE3.

What happens now?

We already know what ending QE does to Treasury yields, because QE has ended' in the past already twice. On both occasions as the below chart shows Treasury yields fell (ie, bond prices rose). In other words, ending QE has been good for the US bond market in the past. The recent rise in Treasury yields isn't down to tapering talk it's due to the existence of large, on-going, but unnecessarily inflationary, QE.

So it's not the talk of tapering that has caused the Treasury market to sell off; rather it is the sell-off in the Treasury market that has caused Bernanke to talk about tapering QE. Treasury yields will most likely fall again when QE actually slows or stops. They have in the past.

None of this should be a huge surprise. Artificially printing money was bound to be very inflationary. So the only time that central bankers could do it would be against a very deflationary backdrop ie, when the broad money supply is shrinking. Since our fractional banking system usually generates new money via new bank lending, zero loan growth stops the money supply from growing. Worse than that, if banks actually shed loans, money supply growth goes into reverse and you risk a 1930s-style deflation (just ask Ireland, Greece, Portugal, Spain or Italy what that's like).

Both British and American banks began shrinking their loan books in October 2008 as the crisis hit. Since then, the better-capitalised major American banks have been able to crystallise loan losses equivalent to 13% of their pre-crisis loans, while maintaining comfortable capital buffers. As a result, they have returned to a semblance of health. Since summer 2011, lending in America has been growing.

Our banks, however, appear to be significantly further behind. That's because they started with far worse leverage ratios, and also had to make big Payment Protection Insurance compensation payouts. As a result, Britain's four largest banks (RBS, Lloyds, HSBC and Barclays) have only been able to recognise losses on about 6.5% of their pre-crisis loans. Exclude HSBC arguably the healthiest and the loan loss ratio drops to closer to 5.5%. So it looks unlikely that British banks can grow lending soon they still have significant losses from pre-crisis loans to deal with.

But in America, where banks are lending again, money supply is being created in a normal fashion once more. That leaves little room for the Fed to print extra money via QE, without the impact being felt in inflation expectations. The way the bond market expresses its concerns about inflationary pressures is by selling bonds and thus pushing yields higher. This appears to be exactly what has happened.

This is hugely significant. If banks are lending again, it suggests they are fundamentally fixed. And if that's so, then they can and will increase lending and generate new money supply. This means the Fed can't print money without triggering inflationary fears, and causing the Treasury market to sell off, which in turn means that QE as a policy tool is on its last legs. There is one major beneficiary from this: the US dollar.

The return of King Dollar

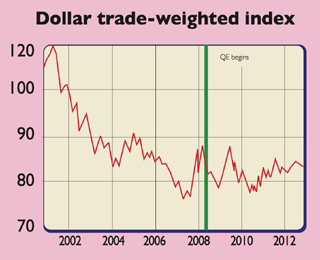

Since QE began, the US has diluted its currency to the tune of some $2.5trn (17% of GDP), putting constant pressure on the value of the dollar. The fact that the dollar hasn't fallen much over that time compared to a trade-weighted currency basket (see chart) is because the dollar is also a safe-haven, attractive at times of turmoil.

But on top of that, the trade deficit (the gap between goods exported and those imported) that the US has been running with the rest of the world has been shrinking. It was above $750bn in 2006 at the dawn of the crisis. It fell below $400bn in the recession of 2009, but even as America has recovered, the deficit has remained on a downward trend: $560bn in 2011, $540bn last year, and $124bn in the first quarter of 2013. It's expected to come in below $500bn for the full year.

The main driver so far is America's increasing energy independence, due to shale oil and gas. But further improvements are on the cards as energy-intensive industries, such as petrochemicals and aluminium smelting, come back onshore (meaning fewer imports and probably more exports).

Here's the problem. The US dollar is the world's reserve currency. We need the US to run a trade deficit, or there won't be enough dollars circulating outside the US for the rest of us to use for trading. Non-US banks hold some $6trn of dollar-denominated assets, so if the US deficit keeps falling at this rate and QE stops flooding the market with excess dollars, we will face a shortage. That will push the US dollar up in value. When Bernanke made his testimony to Congress last month, the dollar had already risen 6.6% in less than four months. When he is finally forced to halt QE, the greenback will move into a new bull trend.

Trouble for China

This puts China, already in a bit of a bind due to its own credit bubble, in a real pickle. China's economic 'miracle' consisted of putting idle factors of production, mainly rural peasants, to work. The mass urbanisation resulted in the export of cheap goods around the world. These exports were kept cheap by China pegging its currency, the yuan, to the US dollar.

Normally, if a country runs a trade surplus (as China did), foreign exchange builds up and the currency rises compared to countries running a trade deficit, until trade balance is restored. For the yuan to remain at the same level as the dollar, and to keep China's inefficient state-owned enterprises "profitable", China had to flood the economy with excess money. Credit boomed and infrastructure investment spending swelled to 40% of GDP.

Then the financial crisis hit. The bottom fell out of exports. Hoping this was temporary, China accelerated the credit boom, taking infrastructure investment up to an unprecedented 50% of GDP. The problem is that while any emerging market usually has plenty of wealth-creating infrastructure projects ready to break ground in the early days, as the system gets flooded with easy credit, less and less efficient projects get built.

According to my colleague at the MacroStrategy Partnership, Andy Lees, in 2007, each unit of debt added one unit of GDP. By last year, it took three times as much debt to lift GDP. In the first quarter of this year, it took 6.7 times as much debt to gain each unit of growth and this doesn't even measure whether such "growth" is wealth-creating or not. In short, China has hit a capital efficiency crisis. Can it possibly afford to keep its peg to a newly revitalised dollar? Unlikely.

China's stock market has been in a bear trend for the last four years. I don't see this changing soon. Inflation has been consistently understated (we just don't know by how much), meaning real economic growth has been consistently overstated. Now, Beijing's central planners have run out of road as far as the credit-fuelled infrastructure model is concerned.

Bubble-high house prices are preventing the consumer from taking over economic leadership as planned. There is a huge government spending plan in the wings that could be brought forward, but most likely China will have to consider breaking the dollar peg and devaluing its currency. The danger then is that the country may face runaway inflation that can't be concealed by even the cleverest statistical sleight of hand in turn, combined with a slower economy, that could lead to serious social unrest. In short, you want to avoid China and related assets.

The QE timeline: how QE really affects US bond prices

Q4 2008: QE1 launches yields rise from 2.1% to 3.5%.

US Treasury yields fell from 5.2% pre-crisis, to as low as 2.1% during the panic in the fourth quarter of 2008. At this point, the first version of QE was launched. This then kept yields up at the 3.5% range for over a year. So during QE1, yields rose by around 140 basis points (bps: one bps = 0.01%).

March 2010: QE1 ends yields fall from 3.5% to 2.4%

In March 2010, when QE first ended, Treasury yields were above 3.5%. By October, just six and a half months later, they had fallen as low as 2.38%. So when QE1 was removed, yields fell by more than 100bps.

November 2010: QE2 launches yields rise from 2.5% to 3.2%In November 2010, when QE2 started, yields were below 2.5%. By June 2011, with QE2 drawing to a close, yields had risen to 3.16%. So over the course of QE2, yields rose by around 66bps.

June 2011: QE2 ends yields fall from 3.2% to 1.4%

By July 2012, in the absence of QE, yields had fallen to a new low of 1.4% a fall of 170bps.

December 2012: QE3 launches yields rise from 1.4% to 2.6%

QE3 has driven yields back up to almost 2.6%. So this time, we've had a QE3-related rise in yields of 100bps.

What should you buy now?

The key is to ensure you have exposure to the rising US dollar. You can do this by holding US dollars, or if you're into currency trading, you could look at options for betting on the dollar. As a London-based stock-market investor, another option is to buy solid FTSE 100 stocks that earn a significant chunk of profits in dollars, such as GlaxoSmithKline (LSE: GSK).

A stronger US dollar is also likely to help Japanese companies, particularly if the Bank of Japan continues to weaken the yen, so stick with Japanese stocks. I'd also be wary of shorting US government bonds. I might even consider buying some later in the year, as they are likely to rally when QE3 actually ends.

James Ferguson is founding partner of The MacroStrategy Partnership LLP, which he started with ex-UBS veteran Andy Lees. Between them they have over 50 years' experience as institutional stockbrokers and market strategists.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

James Ferguson qualified with an MA (Hons) in economics from Edinburgh University in 1985. For the last 21 years he has had a high-powered career in institutional stock broking, specialising in equities, working for Nomura, Robert Fleming, SBC Warburg, Dresdner Kleinwort Wasserstein and Mitsubishi Securities.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets