Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

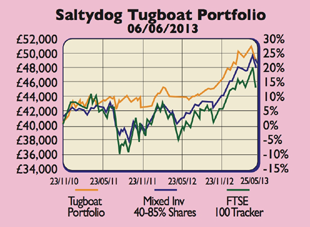

Saltydog Investor aims to boost fund investors' returns via a simple strategy: buy what's rising, avoid what's falling. Here, Saltydog's Richard Webb updates us on its cautious portfolio, the Tugboat'.

Equity markets around the world fell for a second week in a row with the FTSE 100 giving up 1.1%. It was a struggle to find any of the sectors we consider in our weekly analysis making gains. In our Slow Ahead' low-risk grouping, the only sector that saw the leading funds make gains was the Absolute Return sector. The CF Odey UK Absolute Return fund, which we are currently holding, has made 6% in the last four weeks.

In the higher-risk Full Steam Ahead' grouping, some sectors, including the North American, European, and UK smaller companies funds, have continued to make profits, but we wonder how long they can buck the trend. With volatility increasing, and stock markets trending down, we have increased our cash holding to more than 45% by selling the Neptune Japan Opportunities and the Cazenove UK Equity Income funds.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Markets are becoming worried about the end of quantitative easing (QE). Last week's US employment figures came in a little ahead of expectations, which was probably ideal good enough to suggest that the economy was improving, but not strong enough to indicate that the recovery was capable of surviving without further support from QE. But it does feel as though the economic climate has changed, and at some point we will have to move from an environment of QE to quantitative squeezing'. So we would expect the increased volatility to continue.

To sign up for Saltydog's free trial, go to www.saltydoginvestor.com.

| Safe Haven | Cash | 46% | 30% |

| Slow Ahead | CF Odey UK Absolute Return | 21% | 21% |

| Steady As She Goes | PFS Chelverton UK Equity Inc | 7% | 7% |

| Steady SOLD | Cazenove UK Equity Inc | 0% | 10% |

| Steady As She Goes | Baillie Gifford Global Disc. | 20% | 20% |

| Full Steam SOLD | Neptune Japan Opportunities | 0% | 6% |

| Full Steam Ahead | Neptune US Opportunities | 6% | 6% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how