Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The gold market is behaving in ways never seen before.

Would you believe that in recent months the supply of old gold scrap consisting mainly of jewellery sold by owners to turn their metal into cash has actually exceeded demand for jewellery manufacturers, which is by far the most important source of demand? There are even reports of Tupperware-style parties in America, not to buy gold, but to sell grandma's old jewellery to pay for a few weeks' petrol for the car or whatever.

The crisis in the credit system, and the consequent crisis in the world economy, are having major but conflicting effects on the gold price. The developing global economic crisis is driving consumers to cut back on the purchases of jewellery and to turn some of what they already own into desperately-needed cash. That is hurting gold.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the other hand, fear about the safety of banks, and fear that the tsunami of money creation will trigger explosive inflation, are driving investors to increase their holdings of the yellow metal. This is boosting gold. Even central banks, which have been foolishly selling off their bullion reserves for years, are having second thoughts about their policy and cutting back on their disposals.

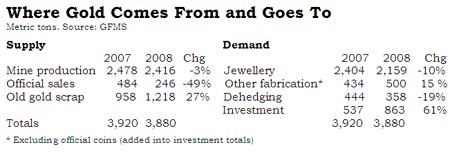

According to research consultancy GFMS's Gold Survey 2009, whose London launch I attended this week, world demand for jewellery fell 10% last year, supply of scrap rose by 27%, official sales halved, investment demand soared 61% (see table below).

As each of the major changes in supply/demand factors impacts on the market, gold prices have been swinging wildly.

Speculation in commodities generally sent gold soaring to $1,011 an ounce in March. Then, as the commodities bubble burst, the price fell to $712 in October as most investment assets were dumped in the deleveraging panic and as the dollar strengthened.

Fear of seizure in the world banking system then triggered a boost of investment interest in gold as the ultimate safe asset, driving the price up to almost $1,000. At which point a surge in sales of scrap into the market seems to have been the primary force bringing prices back to the $850 area.

It's anybody's guess where we go from here.

The continuing strength of the dollar, the growth of cautious optimism that governments' stimulus measures will be successful, and the more immediate impact of economic slowdown on jewellery demand and scrap supply, are all major negatives for the gold price.

If, on the other hand, you expect currency wars to escalate, the credit system to suffer another spasm of agony, and investors to come round to the view that the main result of stimulus policies will be not economic growth but exploding inflation, we could expect gold to surge later this year.

Philip Klapwijk, executive chairman of GFMS, thinks the price (in dollars) may weaken a little further, "particularly during a summer lull," but "an investor-led rally to well above $1,000 this year is quite probable, and a breach of $1,100 cannot be discounted."

Longer-term, gold prices are likely to be driven primarily by investment demand.

That seems certain to grow in a world where the safety of banks is largely discredited, governments are increasingly resorting to irresponsible, even hysterical, financial policies, and the values of major investment assets such as equities and property are likely to remain constrained by an economic environment that will remain subdued, at best.

Worldwide, there is growing interest in holding a portion of one's wealth in physical gold, both in the metal itself and in exchange traded certificates giving direct ownership.

In Asia, purchases of bullion bars rose 62% last year to a new record level of 377 tons. In Europe and North America, investors are re-learning the traditional wisdom of having an "insurance" holding of physical gold. Demand for minting of official coins rose 39% to 191 tons.

Retail investment demand (physical bullion plus metal-backed certificates) tripled in Germany to 108 tons, multiplied nearly six-fold in Switzerland to 89 tons and nearly five-fold in North America to 84 tons.

The amount of gold owned via ETFs and similar certificates grew 36% in 2008 to 1,222 tons.

Most of these kinds of demand are not speculative but primarily long-term investment lock-ups.

The further prices fall below current levels (if they do, as I think they probably will for the next few months), the stronger the case for acquiring more of the yellow metal, the ultimate defensive asset in an increasingly dangerous world for investors.

This article was written by Martin Spring and published in On Target, a private newsletter on global strategy. Email Afrodyn@aol.com

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how