Oil

The latest news, updates and opinions on Oil from the expert team here at MoneyWeek

-

The state of Iran’s economy – and why people are protesting

Iran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

By Simon Wilson Published

-

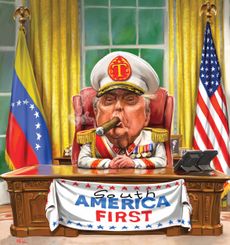

Why does Donald Trump want Venezuela's oil?

The US has seized control of Venezuelan oil. Why and to what end?

By Simon Wilson Published

-

Why Scotland's proposed government bonds are a terrible idea

Opinion Politicians in Scotland pushing for “kilts” think it will strengthen the case for independence and boost financial credibility. It's more likely to backfire

By Matthew Lynn Published

Opinion -

What MoneyWeek has learnt in the last 25 years

Financial markets have suffered two huge bear markets and a pandemic since MoneyWeek launched. Alex Rankine reviews key trends and lessons from a turbulent time

By Alex Rankine Published

-

Overlooked companies' debt and equity to invest in now

Opinion Ian “Franco” Francis, fund manager, Manulife CQS New City High Yield Fund tells MoneyWeek where he’d put his money

By Ian Francis Published

Opinion -

'BP’s days as an oil giant are numbered – a merger with Shell would be the best outcome by far'

Opinion BP has been in decline for some time, could a takeover by Shell save it?

By Matthew Lynn Published

Opinion -

Investors remain calm as the Middle East war unfolds

Conflict in the Middle East has failed to shake oil or stock markets. Can the peace hold?

By Alex Rankine Published

-

Oil price stays steady as tensions in Middle East boils over

Oil prices surged after Israel's attack on Iran, but the global market for the commodity is forecast to remain well-supplied until 2030

By Alex Rankine Published

-

'North Sea oil is ripe for a rebound'

Opinion Labour’s green-energy policy is unsustainable, says Dominic Frisby. That bodes well for British oil explorers

By Dominic Frisby Published

Opinion