How dividend yields reveal when to invest

Dividend yields can be a useful guide as to whether or not a market is cheap. Here, Tim Bennett explains why, and reveals what yields can tell you about American stocks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Dogs of the Dow' is one of the most famous stock market strategies around. It's nice and simple: all you do is buy the ten highest-yielding stocks in the market over a given period (often a year, sometimes every quarter), sell them at the end of the period, then start all over again.

The argument is that by aiming for the highest-yielding stocks, you are by definition buying some of the cheapest and most hated stocks around. Given that investors tend to overreact to bad news, and drive stock prices unfairly low at times, the strategy aims to make money from achieving both a decent yield and a healthy capital gain on top.

The Dogs has a fairly decent track record. But can it work for entire markets too? The answer, says Cambria Investment Management's Mebane Faber, on his blog at www.mebanefaber.com, seems to be yes'.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A recent research paper by Jeremy Schwartz, director of research at exchange-traded-product specialist WisdomTree, entitled "Why we are still bullish on emerging-market equities", notes that "the trailing 12-month dividend yield has been an important valuation indicator for the subsequent performance of the MSCI Emerging Markets Index".

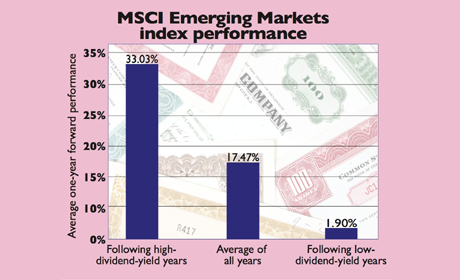

Schwartz looked at the index going back over 24 calendar years. What he found was that the average performance in the year following a year when the dividend yield on the MSCI was high (in turn suggesting the market was cheap) was 33%. This compares to an average annual return across the 24 years of 17.47%. However, when the dividend yield was low, the average subsequent return averaged just 1.9% (see chart).

What's more, four of the five very best annual returns for the index followed years in which the trailing 12-month dividend yields were among the highest for any of the 24 periods. For example, at the end of 2008 the yield was 4.75%. The following year, the index gained a whopping 79%. By contrast, the lowest 12-month trailing yield was seen on 31 December 1999. This preceded a tumble of 31%, the second-worst performance of the 24-year period.

Does this apply outside of emerging markets? Faber looked at the US market going back to 1872. He split each year into high or low yield, with the dividing line being a nominal (pre-inflation) yield of 4.18%, or 1.48% in real terms (after inflation). If you'd bought into the US market at the end of a low-yielding year, your average return would have been 7.5% over the next year (5.1% after inflation). If you'd picked a high-yield year, you'd have gained 13.2% the following year (10.7% post-inflation).

So dividend yields do seem to be a decent guide to whether entire markets are cheap or expensive. Unfortunately, that's not great news for today's investors the nominal dividend yield on the S&P 500 is 2.1%, or 0.12% real. So regardless of how you look at it, US stocks are undeniably expensive, which suggests you'll see poor returns from here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.