Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

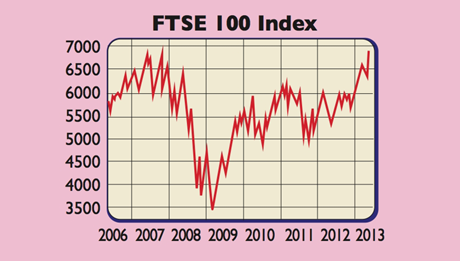

Equity investors are partying like it's 1999, said City AM. Britain's FTSE 100 eclipsed 6,800 early this week. That's not far from its all-time closing high of 6,930, reached on 30 December, 1999.

The blue-chip index has gained 15% since the beginning of the year, and 30% since last summer. The mid-cap FTSE 250 index has already reached a new record, as have America's main stock benchmarks, the Dow Jones and the S&P 500. European and Japanese indices are at new post-crisis highs.

What the commentators said

"Normally," said Jeremy Warner in The Daily Telegraph, the return of animal spirits would presage "better times ahead", but this time there's "a more ominous explanation: central bank money printing", or quantitative easing (QE). The flood of artificially created liquidity is lifting all asset prices, which seem "ever more divorced from economic reality".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The fundamentals certainly don't justify this rapid rally. The prospect of a total meltdown in Europe has receded, but five years on from the crisis, the global economy has still not managed a self-sustaining recovery. As John Authers noted in the FT, since September 2011, global earnings per share have been flat, yet share prices have gained 30%. The latest earnings season has revealed little growth in corporate profits, and "no growth at all in top-line sales". Margins are already high. All in all, then, the earnings picture is hardly inspiring.

But while rallies based on cheap or free money, rather than a solid economic outlook, are always vulnerable to nasty setbacks, there could still be quite a way to go. For one thing, the Goldilocks backdrop an economy hot enough to grow slowly, yet still cool enough to need central bank help is unlikely to change any time soon.

And more and more investors seem to be turning to equities as yields elsewhere slide. "The mood is increasingly turning towards fear of [missing] a melt-up'," reckoned Socit Gnrale's Andrew Lapthorne, "rather than a collapse back down towards disappointing fundamentals".

Nor are stocks expensive yet. So selling in May could be a mistake this year. But what will happen when the "QE-helium tap" is permanently shut off? asked Philip Aldrick on Telegraph.co.uk. Liquidity-obsessed markets have become "completely detached from economic reality it's going to be ugly".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.