Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

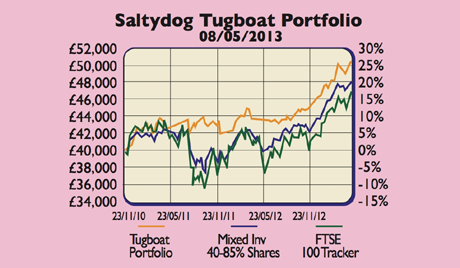

The Saltydog Investor strategy aims to boost fund investors' returns via a simple momentum strategy: buy what's rising, and avoid what's falling. You can read more here. Saltydog's Richard Webb looks at the latest updates to their cautious portfolio, the Tugboat'.

As momentum' investors, we look for the best-performing sectors (using Investment Management Association definitions), pick the top funds in each, and average out their performance to see which area of the market from least risky to most risky is performing most strongly.

Our latest analysis shows that all sectors rose for the second week in a row (for the week to 8/5/13). In our Slow Ahead' group (containing the least-risky sectors), the top sector was Sterling Corporate Bonds'. In the slightly higher-risk Steady As She Goes' group, UK Equity Income' and UK Equity and Bond Income' are leading the way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the top sector, by a long way, is in the most volatile Full Steam Ahead' group. Japanese equities have beaten all others in recent months: the top six funds have each returned more than 20% in the last 12 weeks.

How does this affect our Tugboat' portfolio? We have reflected the resurgence in the Steady As She Goes' sector by hanging on to the Chelverton UK Equity Income Fund (up 24% since we bought it seven months ago). We have now added the Cazenove UK Equity Income Fund, investing £5,000 (10% of the portfolio).

Our top performer, the Legg Mason Japan Equity Fund, is up over 20% in less than two months, and we have raised our holding. We believe in cutting our losses and letting our winners run and we're keen to let this one run.

Click here to sign up for Saltydog's free trial .

| Safe Haven | Cash | 27% | 43% |

| Slow Ahead | Fidelity Moneybuilder Income (Acc) | 20% | 20% |

| Slow Ahead | Henderson Long Dated Credit | 16% | 16% |

| Steady As She Goes | Chelverton UK Equity Income | 7% | 7% |

| Steady As She Goes | Cazenove UK Equity Income | 10% | 0% |

| Full Steam Ahead | Legg Mason Japan Equity | 14% | 7% |

| Full Steam Ahead | Neptune Japan Opportunities | 7% | 6% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.