Why haven't gold stocks kept pace with the gold price?

While the price of gold has shot up to record levels in recent years, the same is not true of gold mining stocks. In fact, they're underperforming badly. That's not the way it's supposed to happen, says Dominic Frisby. So what's going on?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, I am going to address one aspect of what has been the most annoying, the most frustrating, the most galling thing about the stock market over these last five years to me, at least.

That is, the underperformance of gold stocks relative to gold.

Or, to put it in layman's terms, gold has gone up, but gold stocks haven't.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What's that all about?

Gold stocks just haven't kept up with gold

The gold price hit a low of $250 an ounce in 1999, and then again in 2001. For the XAU the index of senior gold stocks the low was 42 in late 2000.

Now gold is trading at $1,720. That's nearly seven times higher. The XAU, however, is trading at about 205 only five times higher.

A five-fold increase may not seem that bad. But you buy gold stocks because they're meant to give you leverage over the gold price. If gold goes up 10%, gold stocks should go up 20% or 30%. That hasn't happened. So what's the point in buying them? You may as well just own the metal.

There are all sorts of reasons for this disappointing performance. But among the biggest is the complete failure by the managers of gold mining companies to grasp how good the fundamentals are for gold. It sounds ridiculous, but it's true. You'd think, being in the gold business, that they would have confidence in the final product, but many don't seem to.

Gold miners were scarred by the epic bear market

This was first apparent in the early part of the century. Many senior gold miners had only managed to survive the awful gold bear market of the previous 20 years by hedging their gold. Because they kept expecting prices to fall, every time gold rallied, the miners sold their production forward (ie they locked in a price for future delivery). If gold fell to $300 and a mining company had sold its gold forward at $500 - it looked pretty clever. And it's the right strategy for a bear market.

But the gold market turned a corner in 2001. So companies that sold their gold forward at, say, $400, only to see the gold price rally to $600 and higher, started to look pretty darn foolish. But, as is so often the case with large corporations, they were generally slow to react to this change.

Take Barrick. It's the world's largest gold producer. The company didn't end its hedging strategy which had served it so well during the bear market until late 2009, when gold was knocking on $1,200. What took them so long?

Juniors have been making big mistakes too

This failure to read the gold market extends across the junior sector too. From 2001 to 2007, it was easy to raise money. Exploration companies would issue shares, raise capital, go out and drill, hopefully declare something half decent, then go and raise some more money at a higher price.

Then we got the credit crunch, and funding dried up. Yet so many companies are still trying to follow this broken business model. They have been decimated this year. The only ones that have done well in 2011 are those that have mined metal at a low price, and sold it at a higher one. It really isn't rocket science. That's what gold miners are supposed to do. But often they don't.

I have long railed about this. The gold price is high, and the credit markets are dead. Gold won't be this high forever so mine the easy-to-get stuff and sell it while you can. Forget expanding the resource, or doing anything else just get mining. This market isn't interested in blue-sky stuff it isn't interested in dreams, it wants hard cash.

Even a mere 50,000 ounces of production per year which is considered small at a cost of $500 an ounce with a gold price of $1,500, means a profit of $50m a year. If your company has a market cap of $50m or $100 million, surely that's a no brainer?

Gold is leading mining stocks, rather than the other way around

In short, gold mining shares are supposed to lead the metal. But so many chief executives have been so slow to believe in higher gold prices and adjust their business models accordingly, that in fact it is gold that is leading the CEOs and by extension, the stocks.

I spent the day at the Mines and Money Conference in London yesterday, and there are signs that CEOs are finally starting to realise this. Instead of relying on capital markets, there's a lot of talk of small-scale production, even of paying dividends in gold.

I must have met 20 companies yesterday who have proven resources of more than a million ounces in the ground, at a late stage of development, good recovery rates, good metallurgy, cash in the bank, with a market cap that values their gold at $30, $40 or $50 an ounce in the ground. One company I spoke with has 1.1 million ounces and a market cap of $9m. That means its gold is valued at just under $9 per ounce in the ground.

So, to the sleepy, complacent bosses of gold majors, I say this: WAKE UP!

You are supposed to be the leaders, the trailblazers, the trendsetters. Many of you are sitting on huge piles of cash. Get your fingers out. Justify your huge salaries with some leadership. Just as the opportunity of the past five years has been to mine gold and sell it; now the opportunity for you is to buy these companies and start mining their gold too. Gold's going higher. Anyone can see that. Big discoveries are getting rarer. Take these companies out while you still can.

Given the evidence of the last 30 years, it could well be another five years at least before managements wake up and start smelling the coffee. But to gold mining investors, I say maintain your exposure to the sector, and stay patient. One day it will happen.

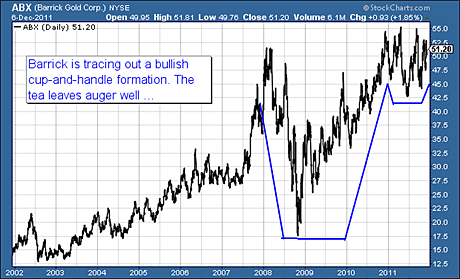

And just before I go, as a side note I quite like the look of Barrick's chart at the moment. It's tracing out a large, bullish cup-and-handle formation (more on that here)

I don't own stock and it is just a pattern, these things often don't work but as long as $42 holds, then if it breaks $55 mark the stock could move above $90 quite quickly. So keep an eye on it.

This article is taken from the free investment email Money Morning. Sign up to Money Morning here .

Our recommended article for today

Why you should buy foreign shares - and how

If you stick to your domestic stock market, you may be missing out on great deals abroad, says Tim Bennett. Here, he explains why you should buy foreign shares, and how to go about it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how