Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

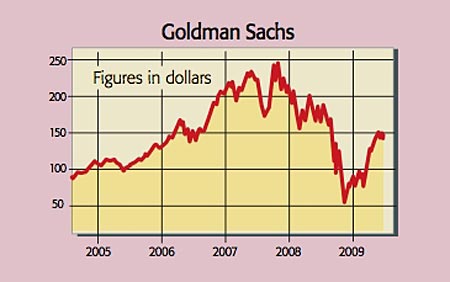

Banking bonuses returned with a vengeance this week as Goldman Sachs reported record profits in the second quarter. Despite the worst banking crisis since the Great Depression, the Wall Street bank managed quarterly earnings of $3.44bn almost double its healthy returns for the first quarter suggesting the bank has turned by the clock to its salad days of 2006.

The firm has already set aside $11.3bn to hand out to its employees for their work over the last six months. The average pay per employee looks set to come in at around $1m this year, according to City AM.

What the commentators said

Is this the return to the bad old days of banking? Absolutely not, said David Wighton in The Times. The "great vampire squid on the face of humanity" as Rolling Stone journalist Matt Taibbi recently dubbed it has made a chunk of that money by providing straightforward services. The demise of its competitors allowed Goldman to earn enormous margins by acting as a market maker in commodities and underwriting capital raisings for its beleaguered peers. "Goldman now enjoys immense pricing power," said Nils Pratley in The Guardian. "Investment banking now looks like one of the world's least competitive industries."

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But don't be deceived, said the FT's Lex column. This squid is swimming with one powerful arm. Trading in fixed income, currency and commodities generated half Goldman's record revenues. That can't last. Competitors will return and clients will lose enthusiasm for trading as the rally runs out of steam. And as investors lose their appetite for government debt, Goldman will also struggle to continue earning fees by finding buyers for this. Then there's the problem of public opinion. Goldman has $171bn in excess liquidity burning a hole in its pocket and is again paying out big bucks. The government could easily opt to cut this sucker down to size. "Calamari anyone?"

The big picture: Goldman Sachs' hedge-fund punt

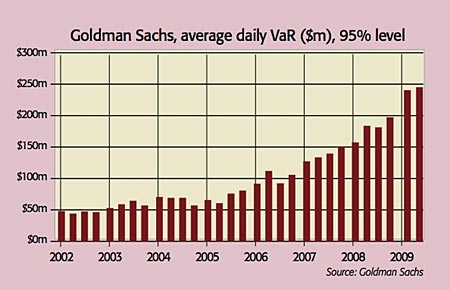

Is Goldman Sachs basically a hedge fund? Its first-half results suggest so: 77% of revenues came from trading on its own account. Exposure to market swings has grown steadily, as you can see from its rising 'value at risk' (VaR, the maximum amount that its traders should theoretically gain or lose in a day, 95 times out of 100).

Of course, simply taking on more risk doesn't guarantee bigger returns Goldman's success is down to winning more big bets than it loses. Past results show days with $100m-plus gains consistently outnumbering those with $100m-plus loses (90 to 36, even in turbulent 2008).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.