Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Rather than review the usual broker tips this week, I'd like to look back on our performance over the past 12 months and pick out the four firms I believe still have the most potential. So how have our buys done?

Assuming that: 1) equal amounts of cash were invested in each stock; 2) adjusting for the date when they were chosen; and 3) ignoring dividends, transaction costs and foreign exchange; then our "Buys" and "Gambles" saw absolute gains of 47% and 43% respectively.

The FTSE 100, meanwhile, was up 21%. Not bad. But not everything went our way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Shorting all of our "Turkeys" would have resulted in a 40% loss, compared to a 38% loss for the S&P 500 Proshares short exchange-traded fund. The moral of this story? Don't short a bull market.

What of the future? For 2010, my portfolio is in defensive mode, split roughly 45% cash, 30% equities and 25% property (my home). I'm convinced many of the successful high beta plays of 2009 will come unstuck.

Take the banks. Wall Street is betting on a 155% earnings jump for 2010, which looks farcical. With headwinds from fewer corporate fund raisings, shrinking balance sheets, greater regulation and more defaults, some big profit warnings are likely down the line.

If we're in the midst of a sustainable recovery, why are so many punters flocking to pawn shops? And why is the cost of buying downside insurance (in the form of put options, for example) still so expensive? To me the recent powerful rally smells like a trap.

So what should you buy now?

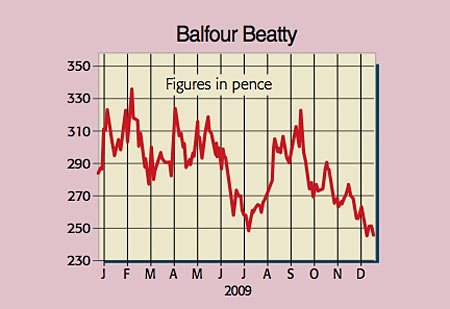

BUY Balfour Beatty (LSE: BBY) at 254p: 40% upside

Balfour Beatty is Britain's largest building contractor. It has net cash of £260m and its £13.7bn order book provides great earnings visibility. In November, it completed a game-changing takeover of US engineering consultant Parsons Brinckerhoff. The deal will create one of the world's largest construction providers, with particular strength in transport and energy infrastructure.

This is important because the extra size and skills should allow the enlarged group to grow more rapidly than its smaller rivals by winning a bigger share of prestigious contracts, such as the 30-year deal to widen and maintain the M25. You see, what the government wants is to hive off its vital infrastructure spending to private organisations. These firms can pay for, design and manage all the necessary work, and later charge the users (via tolls, for example) under long-term pay-as-you-go deals. This boosts job creation without adding to Britain's ballooning deficit.

Also, the acquisition will help Balfour Beatty meet its goal of becoming more geographically diverse. By 2011, turnover will be split 40%-40%-20% across Europe, North America and the rest of the world. The City expects 2009 revenues and underlying earnings per share (EPS) of £9.2bn and 34.7p respectively, while also paying a 12p dividend. That puts the shares on a p/e of just 7.2, with a 4.6% dividend yield.

So what could derail the shares? The main wild cards are those inherent in the industry, including poorly priced contracts, non-performance, fines, customer bankruptcies and/or cut-backs in public spending. On top of that, there's foreign exchange and integration risk resulting from the Parsons deal. Lastly, the £427m pension deficit (net of tax) needs to be watched, although actions have already been put in place to cut this by £115m.

But I'm not put off. With its huge order book and cast-iron balance sheet, my fair value for Balfour is around 350p a share.

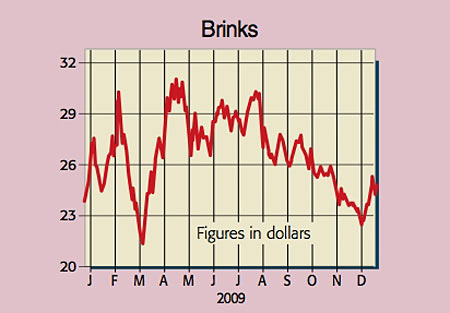

BUY Brinks at $25.50 (NYSE: BCO): 20% upside

In order to focus on institutional clients, HSBC last month decided to kick out hundreds of small-time gold investors who had been storing their bullion in its New York vaults. The upshot was that a fleet of armoured cars laden with gold bars have been ferrying the precious metal to other locations. This is not an isolated incident. With gold fever gripping the world, Brinks is in demand. The company is the global leader in armoured transportation, security personnel and ATM replenishment for banks, retailers and public organisations, with a 19% share of the $14.5bn market.

Brinks has a huge international footprint, with a strong presence in the fast-growing South American region. Wall Street expects 2009 revenues and underlying EPS of $3.1bn and $1.79 respectively, rising to $3.3bn and $1.99 in 2010. That puts the stock on 'bottom of the cycle' p/e multiples of 13.9 and 12.5 for this year and next. I would rate the stock on a ten-times Ebita multiple (see page 40), assuming a conservative 6% margin. After deducting the $35m of net debt, along with $104m of retirement and $245m of healthcare liabilities, that gives an intrinsic worth of around $30 a share.

Fine, but what are the potential curve balls? British investors should factor in currency fluctuations. The group is also exposed to the usual pitfalls associated with bidding and running government contracts. Current performance is also being hit by the poor macro environment, especially due to weakness in the diamond and jewellery trade and a stronger dollar. But with crime levels rising, Brinks looks like a good stock to keep under lock and key.

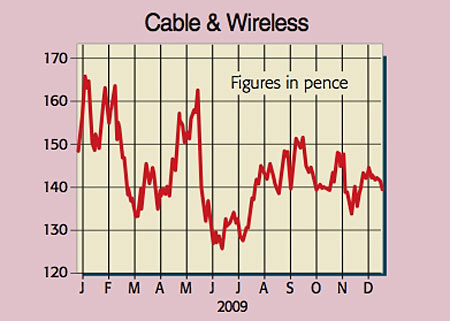

BUY Cable & Wireless at 140p (LSE: CW.): 65% upside

The third musketeer is Cable & Wireless, Britain's second-largest telecoms group. Last month it announced plans to split itself in two by the end of March 2010. The demerger of the separately managed Worldwide and International units is a smart move. Not only will it release hidden value, but it could trigger a bid for one or both entities. Either way, the shares will get a nice lift.

The International unit provides mobile, broadband and fixed-line services in the hotspots of Monaco, the Caribbean, Panama and Macau. It enjoys entrenched positions, but of late it has been hit by falls in local GDP and fewer tourists. But the recession is proving a boon to Worldwide, which offers high-speed voice, data and internet hosting services to clients such as Morrisons and Centrica. That's because, as firms seek to cut costs, they're outsourcing more of their telecom operations to specialists such as Cable& Wireless.

The City expects 2009 revenues and Ebitda (see page 40) to come in at £3.7bn and £975m respectively. On this basis, I'd value the group on a seven-times Ebitda multiple. After adjusting for net debt of £483m and a £305m pension deficit, that gives an intrinsic worth of around 235p a share and there's a tasty 6.5% yield too.

Of course there are the usual challenges associated with operating in a fast-moving environment and going head-to-head against giants such as BT. There are also foreign currency and regulatory issues to consider. But with prospects brightening up, the shares are a solid buy.

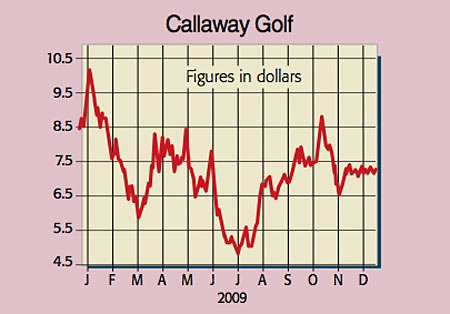

Callaway Golf speculative BUY at $7.79 (NYSE: ELY): 20% upside

It's been a tough fortnight for Tiger Woods. With his private life hitting the headlines, some of his major sponsors (such as Accenture) have chosen to dump the world's top golfer from their marketing budgets. And last Saturday, Woods decided to take indefinite leave from the game.

But there won't be any tears shed at Callaway this Christmas. In fact, it should do rather well from his fall from grace. That's because Woods endorses golf clubs made by its fiercest rival, Nike. If the awful publicity damages future sales, then Callaway should pick up the pieces. It sells leading golf equipment under the Callaway, Big Bertha, Odyssey, Ben Hogan and Top-Flite brands, and is promoted by top professionals such as Phil Mickelson and Arnold Palmer.

Unsurprisingly, given the poor economic backdrop, Callaway is currently loss making. The company has been hit for four by retailer destocking and weak consumer demand. The global golf market is predicted to shrink by 15%-20% this year. But this is nothing unusual for a cyclical business. The board is aggressively discounting, slashing costs and winning market share.

So what is Callaway worth? Wall Street expects 2009 revenues of $937m, rising to $980m in 2010, with a return to profit that year. I would rate the stock on a ten-times through-cycle EBITA multiple. Assuming margins of 10% by early 2012 and discounting back at 12%, that generates an intrinsic worth of around $9.50 a share. Moreover, at today's levels, the shares are trading at just above the value of the net tangible assets ($6.90 a share) and appear to assign little value for all the prestigious brands.

So where are the possible sand-traps? As well as the cyclical nature of the sports-leisure sector, Callaway Golf is exposed to currency fluctuations, changing technology, fickle consumer tastes and tough competition. However, these risks are more than factored into the price, and when the economy does pick up, buying now could prove to be a hole-in-one for the battle-hardened investor. Lastly, even if results don't improve as expected, then a takeover by a larger rival could well be on the cards.

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?