Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britvic is Britain's second largest soft-drinks supplier behind Coke. As well as owning iconic brands such as Robinsons squash, Tango and alcoholic mixers, it distributes Pepsi and 7UP in Britain. All told, it enjoys an 11% share of the £6.1bn take-home (eg, supermarket) sector and a 45% share of the licensed trade (eg, pub and restaurant) market.

I don't think Britvic is a bad business, but I worry about its £388m debt mountain and fizzy valuation. Sure, last week the firm announced it had successfully renegotiated its banking facilities. But this doesn't mean the group is out of the woods just yet.

In fact, most of Britvic's operations are facing challenges. Its Irish business enlarged by the acquisition of Ballygowan water from C&C in August 2007 for a hefty €249m is struggling. Like-for-like volumes declined 5% in take-home and 15% in licensed trade in the last quarter of 2008.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

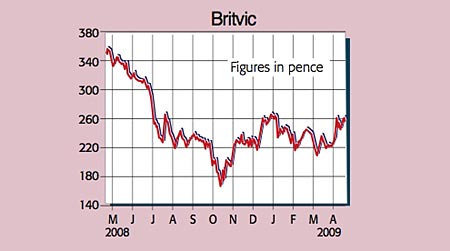

Britvic (LSE:BVIC), rated a BUY by The Independent

Worse, Irish GDP is set to shrink by 8% in 2009, with unemployment leaping to 14%. Meanwhile, UK bottled water sales are drying up as cash-strapped consumers switch to tap water. And on top of that the British Beer & Pub Association says an unprecedented 39 pubs are closing every week.

Worse still, as consumers cut back, many are downgrading from branded drinks to cheaper supermarket own-label varieties. So Britvic distributors are being forced to slash prices and offer two-for-one deals in order to shift stock.

If this trend continues, there is every chance that Britvic will breach banking covenants. Its new three-year loan agreement stipulates that net debt (debt minus cash) shouldn't exceed 3.5 times operating profits. So were its profit margin to drop by only 4%,the dividend might have to be cancelled.

A rights issue couldn't be ruled out either. I think there's a one in three chance of this. Even if Britvic manages to maintain its juicy 10.4% EBITA margin, the stock is still too pricey.

The City is forecasting 2009 sales and underlying EBITA of £948m and £100m, rising to £965m and £112m in 2010. These figures put the shares on stretched enterprise value/EBITA ratios of 9.5 and 8.5 for this year and next.

But I value the shares on a multiple of eight, assuming a sustainable profit margin of 9%. That suggests a price of about 140p. So at current levels, it's not one for cautious investors.

Recommendation: SELL at 254p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn