Investment trusts: how to exploit the discount

Because they regularly trade at a discount to their net asset values, investment trusts, listed alongside normal stocks on a stock exchange, can offer great investment opportunities. Providing, that is, that you know how to take advantage of them. Theo Casey explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Value investors love investment trusts because they boast something no other type of fund can. Trusts which are funds listed on the stock exchange like a normal company will regularly trade at a discount to their net asset values (NAV). Traditional funds may hold stocks that are cheap relative to the market, but they can only be bought at the value of their assets. Trusts can trade at a further discount to the sum total of their holdings. And it's this idea of buying £1 for 90p that sets value investors' pulses racing.

This discount presents some great investment opportunities, since it will often be more profitable for you to buy a trust than a traditional fund. For example, if you'd bought the iShares Emerging Markets ETF (LSE: IEEM) a year ago, you'd have made a 153% return since then. Not bad.

But had you bought the JP Morgan (LSE: JMG) or the Templeton (LSE: TEM) emerging markets trusts you'd have made 160% and 182% respectively. This partly reflects good stock selection by the managers of the funds. But more importantly, it demonstrates the power of buying trusts. You gain a two-pronged play on the theme of your choosing. You benefit from the appreciation of the fund's assets and the narrowing of the discount as demand for the fund picks up.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Discount hunting styles

There are several approaches for investors trying to take advantage of this discount.Primarily, the discount is a function of supply and demand. A widening discount tells you that there are more sellers of a fund's shares than buyers and vice versa. So when a trust trades at a discount, then common sense tells you that there is potential for this to narrow if demand for its shares picks up. However, for you to benefit from this, you must correctly identify the types of investments that are likely to come into favour with investors. If your trend-spotting skills are sharp, you could do well from the strategy of using trusts rather than ETFs or other trackers to invest in a theme.

Another alternative is to look for corporate actions that could close the discount. Shareholders (often activist hedge funds) that build significant stakes, may table special resolutions for voting on at shareholder meetings. One example of such an action would be a change of management. A discount is often the result of an under-performing manager making the wrong decisions. Should a safe pair of hands come in to take over the fund, demand should rise.

Another possibility is converting the trust into a standard open-ended fund. This tends to happen at NAV, thus allowing investors to crystallise the discount. Alternatively, shareholders may push to wind up the trust, sell its assets and receive the proceeds. These opportunities are intriguing. But with over 300 trusts out there, reading through all the filings regarding new managers or other corporate actions is very time consuming.

Putting a floor under the discount

An easier solution is to look for trusts with 'discount floors'. This is where boards commit to a discount level under which the trust will not trade. In the event that a fund's discount does fall below this line, the manager has the option to use the company's cash to buy back shares in the market, which should close the discount. Thus a large discount in a trust with a discount floor represents a buying opportunity. Let's look at three examples.

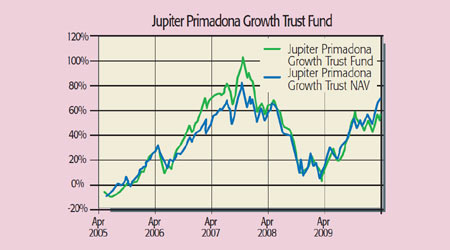

Jupiter Primadona (LSE: JPG) trades at a 16.4% discount to NAV. What's interesting is that the discount target is just 4%, according to data from Numis. So there's a theoretical 12% worth of buybacks the fund manager should be targeting. So far, the firm has shown it's willing with £870,000 worth of buying. The fund invests purely in stocks and counts HSBC, BP and a US small-caps fund among its core holdings.

Iimia IT (LSE: IIM) is a fund of funds that intends to purchase shares through the market in the event of the share price moving to a discount of more than 3% of the NAV per share. It has a large stake in a global bond fund and operates slight gearing (109%), meaning that it borrows money to invest. While this fund is far below its floor (-13.8%), one reservation is that it invests in other trusts that may or may not operate discount control policies.

Investors Capital (LN: ICTA) is a company that can repurchase its own shares when the market price stands at a discount to NAV of 5% or more. The fund doesn't operate any gearing and pays a decent yield at 6.5%. It also invests in some very fine blue chips, including GlaxoSmithKline and British American Tobacco. The bond holdings are largely investment-grade issues, such as France Telecom and Kraft.

Funds that keep their promises

Of course, there are limits to this. Managers generally have the option to buy, rather than the obligation to keep the discount under control. What's more, a report by broker Numis claims that managers are not always consistent with their policies, saying "we have always been sceptical about the ability of boards to maintain arbitrary discount levels". The study cites examples of small-cap funds that eventually widen their discount floor so that investors no longer get the tight discount that was promised.

Still, the big houses tend to keep their word: global growth funds from F&C and Witan "have been successful in protecting discounts through buybacks and have transformed their shareholder registers over time", says Numis.

Established trusts like Investors Capital (run by F&C) and Primadona at significant discounts look good bets. In fact, Jupiter has spelled out its intentions. "It is not in shareholders' interests for the shares to trade at a significant discount." With a recently implemented policy to address this, the fund is compelling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Theo is a former financial writer and editor, having written for reputable titles such as Euromoney Institutional Investor and Redwood Publishing. He has also appeared on-screen with Al Jazeera, BBC and CNBC and on MoneyWeek Theo covered funds, share tips and stockmarkets. He also edited the country's oldest newsletter with Lord Rees-Mogg for four years. Theo now runs his own content marketing agency for financial companies, and he is a seasoned CISI-qualified investment adviser.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge