Turkey of the week: precarious home-improvement chain

This home-improvement retailer is faring well in a tough climate, with interim results slightly above forecasts. But with the UK housing market still on a knife-edge, the company is not out of the woods yet, says Paul Hill.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Kingfisher is Europe's biggest home-improvement chain and the third largest in the world, with operations in the UK (44% of sales), France (40%), Poland, Russia, Turkey and China.

Its main retail brands are B&Q and Screwfix in Britain, and Castorama and Brico Dpt across the Channel. Its other operations are much smaller yet still profitable.

The firm is faring well in a tough retail climate. Last month it reported interim results slightly above City consensus, with like-for-like sales up 1.4%. This robust performance was driven by B&Q, which benefited from good weather in May and June, and renewed consumer interest in DIY.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The demise of rival MFI also boosted kitchen, bathroom and bedroom sales. Profit margins rose thanks to reduced discounting, a better product mix and a more efficient supply chain.

This was a creditable result, but Kingfisher is not out of the woods just yet. The UK housing market is still on a knife edge. Sure, the sharp reduction in interest rates has lowered mortgage payments, temporarily putting more money into people's pockets to renovate their properties.

Kingfisher (LSE: KGF), tipped as a BUY by ING

However, once government handouts are withdrawn and tax rates hiked in 2010, household budgets will be cut. Chief executive Ian Cheshire admits that Kingfisher is "unlikely to see another bounce in 2009" and is "bracing itself for difficult conditions ahead".

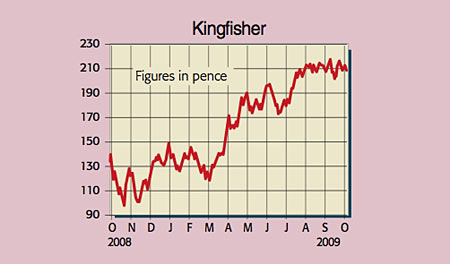

And difficult it will certainly be: the British Retail Consortium says UK retail sales fell 0.1% in August. However, none of this has stopped Kingfisher's shares soaring more than 100% over the past 12 months to trade on a lofty p/e ratio of more than 15.

I would value Kingfisher on a multiple of just nine times underlying operating profits, which, after adjusting for the £740 debt pile and £244m pension deficit, generates an intrinsic worth of about 170p/share. It's time to take some profit off the table.

Recommendation: SELL at 220p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.