Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This stock market rally is yet another con.

The analysts were "low-balled" to record breaking effect. Here's the story

Second quarter earnings season is going to be a record breaker.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Most of the companies in the US and UK that report their figures in the second quarter have already done so. And as much as 77% of them have beaten the consensus earnings expectations. According to Thomson Reuters, this is the biggest outperformance in stock market history.

Even though comparable profits are down about a third from last year, share prices have been rallying all around the world. It's due to a ritual performed in the City of London and on Wall Street year-in-year-out during earnings season. It's called "beating analysts expectations" and it goes something like this:

1. Company X low-balls the City i.e. gives analysts conservative forecasts on its expected future earnings.

2. The analysts take those numbers as gospel and plug them into their sophisticated pricing systems. Some tinkering later, the analysts come back with a target price for up to 12 months in the future.

3. With this manufactured conservative forecast in place, Company X then releases the actual results which are typically "better than expected."

Barring catastrophic losses, this little dance is one way to elicit rising target prices. This leads to upgrading the recommendation, which leads to more optimism and most importantly, more rising stock prices.

Although this is a record breaking outperformance, it's not unusual for the analysts to be a step behind

Why you should use analysts as contrarian indicators

To quote James Montier of GMO: "Analysts lag reality. They only change their minds when there is irrefutable proof they were wrong, and then only change their minds very slowly."

The outperformance of three quarters of the stock market proves this theory. You need to take what professional number crunchers tell you with a big dollop of cynicism. Analysts, like regular investors, tend to herd around one point of view and are slow to react to the often sudden changes in the market.

By cutting your own path, you might just get to the truth before the masses do. And if you do this, you could set yourself up for the next big profit opportunity, or save yourself from the next big fall in the market.

Now that analysts have finally turned positive, it might already be time to retreat from the riskier edges of the market.

The dangers that lie ahead

The investment banking analysts are queueing up to tell us it's time to buy.

Most recently, Japanese bank Nomura joined the bullish pack. It's optimistically putting a 5,300 target price on the FTSE 100. But this bullishness doesn't seem sustainable because it comes in the context of a "jobless" recovery.

You see, rather than actually increasing sales reported revenue was 2% lower than the first quarter most companies maintained earnings by firing staff and cutting costs aggressively. It's a temporary fix but at some point, real "top line" growth has to kick in.

With consumers across the world still losing jobs, borrowing less and saving more, it's hard to see where that growth is going to come from. Worse still, it makes some parts of the market likely to start disappointing the newly optimistic analysts.

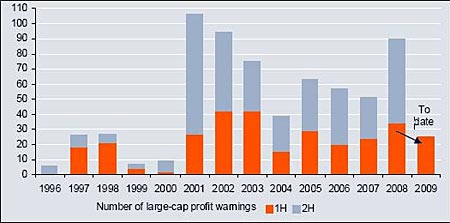

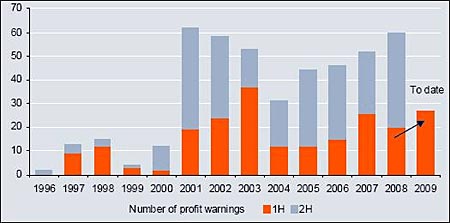

In this worrying economic outlook, large caps continue to look like a good idea. As you can see from the chart below, large caps have reported fewer profit warnings. This is not surprising as mid cap stocks tend to be more cyclical and therefore more prone to upset.

Larg-cap profit warnings

Small-cap profit warnings

Source: ING

The large caps currently have the most going for them. These companies are sector bullies that dominate their respective industries. They have the power to pass on costs without the threat of losing their customer base. In order to play this trend, there are four areas of the market to focus on: Food retailers, telecoms, tobacco and utilities. In these sectors, defensive shares such as United Utilities (LSE: UU), Imperial Tobacco (LSE: IMT) and Tesco (LSE: TSCO) all look undervalued and due for a bounce back as inflation joins the bear market as a major headache for UK investors.

This article was written by Theo Casey, investment director of the Fleet Street Letter , and was first published in the free daily investment email The Right Side on 29 July 2009.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how