Profit from pampered pooches

Pets are big business. 63% of American households have at least one pet, and spending on pets has nearly doubled over the last decade. Many new players have entered the market. Eoin Gleeson examines the sector, and picks the best company to invest in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

At the age of 14, Chuckie the cat developed diabetes. Then a thyroid problem. Then he started having seizures. Soon he was surviving on a cocktail of drugs and knocking into furniture as he struggled to keep his balance. It was no life for a cat. So his owner faced a dilemma. Keep paying for hugely expensive procedures to prolong the life of her beloved cat or let him go?

It's a dilemma faced by thousands of households. It may seem incredible to non-pet owners, but consumer spending on pets has nearly doubled over the last decade, with the US (perhaps predictably) leading the way. All that lavish spending means cats and dogs, just like humans, are living much longer, and running up major medical bills in the process.

In 1987, about 32% of America's dogs were over the age of six, according to the American Animal Hospital Association. Now 44% have passed that threshold. Pet owners are taking full advantage of advances in medical technology, meaning that detecting illness in pets regularly involves MRIs, ultrasound and CAT scans. Even kidney transplants and chemotherapy are now viable options for a sick pet.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That spending is being driven by a powerful demographic force: loneliness. Baby boomers who face an empty nest and long retirements are spending a fortune for companionship at the pet store. And with young couples delaying the decision to have children on both sides of the Atlantic, pets are being brought into younger households too.

In America, 63% of households now have one or more pets. Sales are holding up well in the recession pet owners are on course to spend $45bn this year on their cohabitants, up 5% on 2008.

Where does all that money go? The largest part of the pet business is dried goods. Mass-market pet food accounts for 40% of industry sales. Medical bills account for another hefty chunk of that spending last year $9.8bn went on supplies and over-the-counter medicines.

That kind of money has attracted a lot of new interest in the industry. Big marquee retailers, such as Wal-Mart, Target and Cost-co, have all recently made room for a new line of pet products. Wal-Mart is taking on industry leader Petsmart's dominance by devoting floorspace to pet grooming stations. Even motorcycle maker Harley Davidson plans to offer pet foods, clothing and shampoos.

So many new players have been drawn into the market that it's now getting crowded. Nervous pet-food retailers are trying to develop more profitable product lines to avoid being squeezed out. Petsmart has moved into everything from orthopedic beds to nappies for dogs. The company's "animal stylists now wash, blow-dry, clip, brush and beautify about 20,000 dogs every day", says Jay Palmer in Barron's.

But the big retailers will find it hard to muscle in on the medical upkeep market, which requires a lot more specialist knowledge. Sales of veterinary services and medicines are expected to remain strong. Owners feeling the squeeze might scale back on cosmetics and prime cuts of cat and dog food sourced from New Zealand, but they'll still make emergency trips to the vet when their puppy eats a pound of fertiliser in the shed.

And even though Chuckie's owner decided to let him go in the end ("I have limited resources", she told The Washington Post), pets in less critical condition will still get their drugs during the recession. "We estimate veterinary services spending will grow 4% in 2009 and 8% in 2010 to reach $16.4bn by 2011," says Michael Dillon of Pet Industry Weekly. We look at the best stock to buy in the box below.

The best bet in the sector

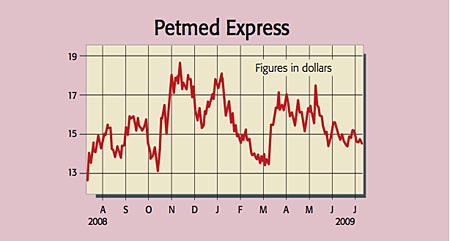

Petmed Express (Nasdaq: PETS) is a screaming bargain, says Jake Lynch on The Street. The Florida-based business operates under the name 1-800-Petmeds. It's a mail order company that markets prescription medications for dogs, cat and horses via catalogues and the internet.

Most pet medications (about 70%) are sold by vets. Another 17% are sold by retailers, and 11% are bought online. Petmed controls more than 50% of the online market. The group faced a slew of lawsuits when first set up, as it undercut vets and sold controversial treatments.

But it has since cleaned up its act and now works with vets, generating much of its business from repeat prescriptions, which it sells for about 15% less than the typical surgery.

The group has enjoyed eight straight quarters of double-digit growth in earnings. Revenue for the last quarter rose 19% to $48m, and earnings per share climbed 25%, as its customer numbers grew to 802,000, from 710,000 the previous year.

It's also in good financial condition, with no debt and more than $30m in cash. "A quick ratio of 4.72 indicates it's sufficiently capitalised to withstand a significant decline in business," says Lynch. The stock trades on a forward p/e of 12.3.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.