Profit from China's medical reforms

Beijing is to spend $125bn over the next three years on thousands of new clinics and hospitals. That will be a major boost to China's medical device industry as money is spent on locally produced, low cost medical equipment. Eoin Gleeson examines the sector, and picks the best company to invest in now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

How Barack Obama must secretly envy Chinese premier Hu Jintao. While Obama has been locked in a battle over healthcare reform, his Chinese counterpart has simply ploughed ahead. In April, Hu announced that Beijing will spend $125bn over the next three years on thousands of new clinics and hospitals. And ministers applauded politely.

But this is a major u-turn. In the 1980s, China abandoned its socialist healthcare system and cut public services to much of the population. As private enterprise took over major city hospitals, health costs spiralled, so many Chinese resorted to home treatment. There are more than 300 million Chinese without any kind of healthcare cover, says Steven Mufson in The Washington Post. And a single hospital admission can cost almost a year's income for the average citizen.

But now worried about a popular backlash Beijing is trying to win back control. Within three years, the government aims to build at least 2,000 new county hospitals and 29,000 village clinics. Another 3,700 urban centres and 11,000 health clinics are to be rebuilt or restructured. Overall, a major shift in funding is underway from large tier 3 hospitals with more than 1,000 beds towards smaller clinics and hospitals, according to China Market Research Group. China's rural healthcare sector, for example, has 39,441 poorly equipped township clinics. Beijing will aim to provide basic equipment for disease diagnosis, treatment and patient transfers.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That will deliver a major boost to China's medical device industry. More than 70% of medical devices used in top tier 3 hospitals are from overseas firms, according to SinaMed Consulting. Under Beijing's latest plans, money will be redirected to supplying rural clinics with locally produced, low-cost devices, says Glenn Hou of research group Frost & Sullivan. The stimulus package includes $1.2bn for the purchase of X-ray machines, patient monitoring devices and ultrasound scanners for rural areas.

Update: VopakOil storage groupVopak (Euronext: VPK) has enjoyed a strong run on the back of crude stockpiling it's up 65% since we tipped it in April. But oil in floating storage hit a ten-year high this week. With crude at $79 a barrel, we may not be very far off the peak for oil storage. Now looks a good time to take profits.

Demand for cheap medical equipment will also be driven by small, urban hospitals, says Hou. There are 5,151 tier 2 hospitals and 2,378 tier 1 hospitals already teeming with urban patients. Growing prosperity and changing diets mean urban Chinese are increasingly prone to Western ailments. Cardiac patient numbers in Chin are growing at 20%-30% a year. So the market for cardiovascular stents is growing by 40% annually, says Shaun Rein in BusinessWeek.

Overall, says pharmaceutical researcher Episcom, the value of China's medical device market will reach $28bn by 2014 more than double the 2006 figure. So while Chinese equipment exporters might face slumping sales, those focused on producing cheap, low-end devices for rural and small, urban hospitals have a powerful new backer in the form of the Chinese government.

Some 86% of the total government device funding should arrive next year and in 2011, says Susquehanna analyst Ding Ding. We look at one stellar Chinese producer of low-end equipment below.

The best bet in the sector

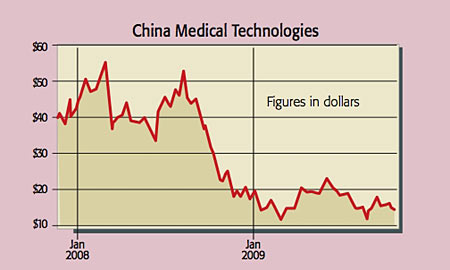

China Medical Technologies (Nasdaq: CMED) looks to have a bright few years ahead of it, as the bulk of stimulus spending on medical devices has yet to come. The China-based company develops, manufactures and markets advanced in vitro diagnostic (IVD) tests for diseases such as leukemia and cervical cancer for mainly tier 1 and 2 hospitals. This is the sort of area that will be a focus of China's healthcare stimulus programme, according to Glenn Hou.

Nonetheless, 2009 has been a torrid year for China Medical. Its high-quality products had previously been selling well on the back of substantial price discounts to foreign firms. But early this year, the competition intensified from both foreign and domestic IVD manufacturers. With medical spending collapsing, customers started abandoning its products for less expensive alternatives. Quarterly net income slumped by 93%. In response, from 1 September, China Medical slashed the prices of its diagnostic kits by 30%.

But with medical spending picking up under the stimulus plans, its focus on the smaller tier 1 and 2 hospitals sets it up for a strong rebound as hospitals order its now-cheaper testing devices. The firm's shares trade at a discount to sector leader Mindray, on a forward price/earnings multiple of eight and a 3.5% dividend yield.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how