Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You probably already know there's a phenomenal investment opportunity in natural gas right now. But here's the background

Natural gas is an extremely useful fuel. In 500 BC, the Chinese used natural gas to turn seawater into drinking water. In Victorian England, they used it to power streetlights. When I traveled around Asia back in August 2008, I found them using natural gas to fuel taxis. And in Canada, they run their buses on natural gas.

In America, we mainly use gas for heating our homes, generating electricity, and for running our factories and other industrial processes like pulp and paper manufacturing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

(There is also a small but growing market in America for fuelling vehicles with natural gas. There are currently 120,000 natural gas vehicles on the roads and more than 1,100 natural gas fuel stations in the US.)

In total, natural gas accounts for about 23% of the total energy used in America.

And not only is it extremely useful, but it's the cleanest of all fossil fuels. According to the Energy Information Administration (EIA), at the same energy level, natural gas produces 29% less carbon dioxide than oil and 44% less carbon dioxide than coal. Burning natural gas also produces far less sulphur dioxide, nitrogen oxides, mercury, and particulates.

This is important to the world's bureaucrats, who are on a mission to reduce the amount of carbon dioxide and other pollutants we release into the atmosphere.

And America is loaded with natural gas. It's the second-largest producer of natural gas in the world after Russia, and may have the world's largest reserves. This makes natural gas attractive from a strategic perspective, as we control the supply. It also makes it popular with the politicians. The more natural gas we use, the more American jobs the government can claim it has created.

But here's the dealmaker for investors

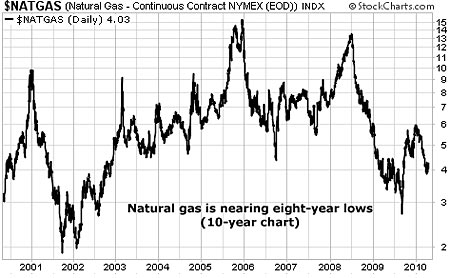

Over the last 18 months, natural gas has fallen over 70% in price and is now close to its lows of the last eight years.

While natural gas prices are still at 2002 levels, crude oil prices have tripled. So natural gas also looks extremely cheap when compared to its most important competitor

To put this value in perspective, at today's prices, to generate 10m British thermal units (BTUs) of energy using crude oil, you'd have to spend $148. To produce the same energy levels using natural gas, it would only cost you $39. So in terms of energy content, oil is 3.8 times more expensive than natural gas

That's the basic investment case for natural gas. It is useful, clean, abundant, American, and very, very cheap.

So how do you invest in natural gas?

You can buy it directly with an exchange-traded fund (ETF) or invest in a company that produces natural gas. But utility companies that use natural gas to generate electricity are my personal favourite natural gas investments.

First of all, natural-gas-burning power companies are going to be busy for many years to come. Because gas is so cheap, this business makes perfect economic sense. And it makes political sense too (remember, it burns clean and it's American).

Second, this idea is much safer than "pure" natural gas investments like the natural gas ETF or natural gas producers. Natural gas is one of the most volatile commodities in the market. By buying power producers, we benefit from natural gas's great investment thesis without having to put up with the incredible volatility.

And most importantly, power utilities pay dividends usually between 4% and 6%. By investing in natural gas power utilities, you're able to leverage the excellent investment case for natural gas into a safe, high-income idea.

Right now, my favourite natural gas utility play is Atlantic Power (TSE: ATP), which trades in Toronto. Atlantic produces 1,823 megawatts of power, and natural gas accounts for 80% of this generating capacity. Atlantic's most important power plants are in Florida, New York, California, and Texas. Formed in 2004, it has grown cash flows and raised the dividend per share three times in the last four years. At current prices, Atlantic pays a 10% dividend.

Natural gas has a powerful investment story right now. I consider Atlantic the safest, "high income" way to participate in the coming bull market

This article was written by Tom Dyson for the free daily investment letter DailyWealth .

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how