Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Unless you're a medical expert, you'll probably never have heard of ISIS Pharmaceuticals. But in five to ten years' time, assuming things go according to plan, this biotech outfit could be a household name. That's because it has developed a ground-breaking new technique called 'antisense'.

Many of today's most common diseases such as cardiovascular problems, cancer and diabetes are caused by 'bad' proteins being wrongly produced in the human body. Current drugs attack these dangerous cells, but the problem is that the side effects can be extreme, and the efficacy poor.

In contrast, antisense operates one step ahead in the DNA chain. It stops these disease-causing proteins from ever being generated by turning off the genes that encode the protein. This means none of the 'good' cells are harmed, so the side effects are far fewer, and the treatment can be tailored to each individual patient.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

ISIS owns 1,600 patents and currently has 19 drugs in the pipeline, most of which are being jointly developed with partners such as Genzyme, Bristol-Myers Squibb and Novartis.

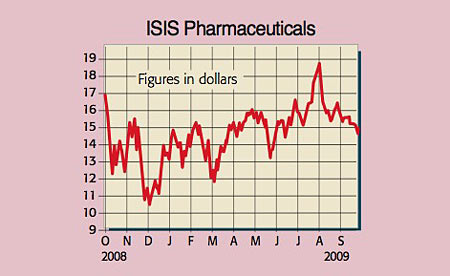

ISIS Pharmaceuticals (Nasdaq: ISIS)

ISIS's first potential blockbuster drug is Mipomersen, which is aimed at cutting cholesterol levels. It's presently undergoing Phase III clinical trials; submission to the US regulator, the FDA, is set for 2010. So far the results have been very encouraging. The chief executive said in August that "key opinion leaders with whom we have shared the detailed data are thrilled".

Assuming he's right, and the FDA approves Mipomersen in 2011, shares could rocket overnight. A positive verdict would not only give the green light to this specific treatment, but would more importantly provide a huge endorsement to the whole antisense drug class. There's also no danger of patent expiries until 2023 at the earliest, and the group has $500m in net cash (or $5 a share) to fund itself for the foreseeable future.

What are the potential pitfalls? As with most early-stage biotechs, ISIS is still loss making and its success depends on one main therapeutic area. But with antisense being such a breakthrough, ISIS looks a good bet on the long-term growth in personalised medicine and ageing populations, along with being a takeover target for Big Pharma.

Recommendation: speculative BUY at $14.50 (market capitalisation $1.4bn)

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how