Biotech survivors to buy now

Buying biotech shares has always been a gamble, with companies that promised the world, but never quite delivered. But that doesn't mean investors should just forget about the biotech industry. Richard Hemming investigates, and picks the best bet in the sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The biotechnology sector has always been an area that promises the world, but has never quite delivered. Investors first piled into the sector in the 1990s when they saw billions of dollars being made by industry pioneers such as Genentech, Amgen, Biogen and Genzyme. These American firms were among the first to use gene manipulation to create a whole new genre of medicines.

The biotech pioneers proved you could use living cells rather than chemicals to create potentially more effective remedies that target the cause of the disease at the genetic level. It's a shrewd move at a business level too, because generic or cheaply made copycat versions of such treatments are harder to develop.

Yet enthusiasm for biotechs has waned considerably in this decade. For one thing, innovation is getting harder. Many drug firms lament that "all the easy cures have been found". Regulators are also approving fewer drugs, partly because of the threat of patient lawsuits. The US Food and Drugs Administration passed 25 new drugs in 2008. That's only a little more than they approved 25 years ago, during which time spending on research and development has more than trebled. More recently, the credit crisis has seen investors turning the funding taps off.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Recent disappointments include the Shire Pharmaceuticals-backed Renovo, which develops scar-reduction technology. Once seen as among the sector's best prospects, in mid-September it said it was cutting a third of its workforce after takeover talks ended. Meanwhile, shares in cell therapy group Intercytex were suspended this month after it, too, failed to attract a bidder. And gastrointestinal disorders specialist Alizyme and York Pharma both went into administration within weeks of each other this summer.

Part of the problem is that buying into biotech is too often like going to the casino. Many biotechs have just one or two products in development. The hope is that one of these will be approved by the regulators and become a blockbuster drug. But more often, the product crashes and burns, along with the share price. Such high-profile collapses have hammered investors' confidence in the sector. Two years ago, Britain had more than 110 listed biotechs. Today, there are still around 90, but fewer than a dozen of these have a solid business with revenue streams or deal with larger firms.

So should investors just forget about biotech? Let's not be too hasty. One factor in the sector's favour is increased government involvement. The Innovation Investment Fund, a £150m venture capital fund, is meant to invest alongside private partners and aims to invest £1bn over ten years. In September, long-time sector supporter Sir Christopher Evans' investment vehicle, Excalibur, bought International Bio-sciences Managers, a biotech advisory and fund management firm.

While these developments are positive for the firms involved, they don't make it any easier for investors to avoid backing duds. But as the sector matures, a better business model is coming to the fore. These biotechs or 'speciality pharmaceutical firms' don't rely on the 'blockbuster or bust' model that has ruined so many of their smaller rivals.

Instead, they already have one or more successful products, meaning they can sustainably fund their extensive development pipelines without constantly raising more funds from investors. There will be further bloodshed in the sector, but it is highly unlikely to be in these businesses. We look at a promising stock in the box below.

The best bet in the sector

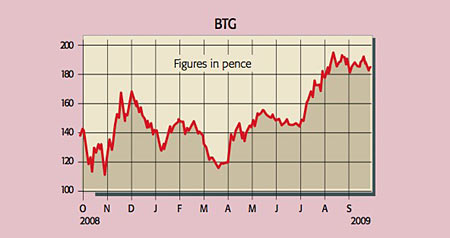

BTG (LSE: BGC) is a transformed firm. This time last year the only thing that mattered was the success of its varicose veins treatment, Varisolve. Good safety results had cleared the way for final stage trials in America. But investors were underwhelmed. Late stage trials are the most costly and BTG hadn't found the biotech Holy Grail a big partner to fund it.

But fast forward 12 months and Varisolve is a far less important part of the picture: what matters more is BTG's consistently growing earnings. In December, BTG bought another biotech, Protherics, and now has £100m of US sales to look forward to. It also has a large pipeline of research and development projects eight of which it's developing on its own, including Varisolve, and a further eight it has partnered out with big drug firms.

BTG now aims to use its £78m cash pile to fund further growth, rather than having to pour it all into research. Robin Davison at Edison Investment Research values the group at 297p a share. A potential deal for Varisolve is a key catalyst for the share price in the short term, he says. But long-term, BTG's real attraction is its transformation into a speciality pharma group making consistent profits a "novelty for such companies in Britain."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?