A canny bet on stem cells, the future of medicine

Stem cells hold enormous potential to revolutionise medicine, and there will be big profits for the biotech companies that develop successful treatments. But the sector is frought with danger for investors. Here, Eoin Gleeson picks the best way to profit from this medical revolution.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The balance of power between the sexes may be about to swing decisively. Last week in Newcastle, scientists found a way to develop sperm in a test tube using stem cells from a five-day-old male embryo. At a stroke, the potential of stem-cell research was brought home to men across the world. For how much longer will we be needed?

A while yet it seems. For one thing the stem cells that were used to create the sperm could only have been derived from a male embryo, according to Professor Karim Nayernia of Newcastle University. So at least one male will always be required. And it will also be a long, long time before this type of experiment will produce a commercial fertility treatment. The regulatory authorities may have given a green light to the first-ever human trials using embryonic stem cells in January. But that doesn't mean we can suddenly expect a string of medical miracles. Indeed, Forbes's Michael Fumento estimates that stem cells are at least a decade away from generating a profitable and sustainable treatment.

It's partly a question of biology. Stem cells are essentially the master cells in the human body. Adult stem cells can already be extracted relatively easily from bone marrow, for example, and then treated to generate more bone or new cartilage. But their range of possible uses is restricted because, being from an adult, they are already mature.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That is not a limitation that applies to embryonic stem (ES) cells. However, it is difficult to predict what kind of tissue ES cells will become. Some, for example, have a nasty tendency to form malignant tumours called teratomas literally 'monster tumours' which can contain random bodily structures such as eyes and teeth. Another risk is immune-system rejection. "Introducing stem cells into a body is a bit like transplanting an organ," says The Economist. "The immune system might throw a wobbly and try to destroy the intruder." So patients need to take powerful immuno-suppressive drugs, often with unwelcome side effects.

The scientists are not about to give up. Embryonic stem cells are much more versatile than adult cells victims of spinal or brain injuries, for example, could eventually be nursed back to health with regenerated stem-cell tissue. And there will be big profits for companies that develop successful treatments. So Pfizer has established a $60m stem-cell therapy research centre in Cambridge, and GlaxoSmithKline has put up $25m to sponsor research at Harvard. The problem for an investor is the potentially long wait for a return and the risk of investing in a stem-cell group whose research fails.

That's why adult stem cells are a cannier bet. They have already been used to treat scores of illnesses including many cancers, auto-immune diseases, neural degenerative diseases and a host of other blood conditions. Adult stem cells are also easier to come by than embryonic cells and less expensive to run in clinical trials. And they are still reasonably versatile. So even if a company's trials hit a snag in the treatment of one ailment as happened to stem-cell pioneer Osiris Therapeutics last month when one of its drugs was found to be no more effective in treating a pulmonary disease than a placebo there are often other illnesses that will respond to the same treatment.

In short, "adult-derived cells are the ones that have been studied for the past ten to 15 years and are ready for prime time," says Debra Grega of Case Western Reserve University. We have a look at how you can benefit below.

The best stock in the sector

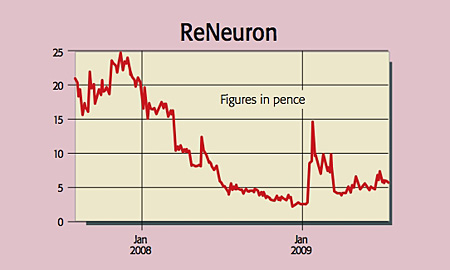

ReNeuron (Aim: RENE) is the only UK-quoted company focusing entirely on producing adult stem-cell therapies. The company has two that could prove themselves very quickly, according to Tom Bulford in The Penny Sleuth.

First off, it is waiting for final approval to start clinical trials on a treatment for stroke patients. An update on regulatory clearance for this treatment is imminent. "I'm pretty confident it will get final clearance," says Vadim Alexandre, analyst at Daniel Stewart. Even then a successful treatment is at least two years off.

However, the second therapy for an unpleasant side effect of diabetes is closer to a breakthrough. Those suffering from diabetes often lose circulation, especially in the feet which can become black and swollen and even need amputation. ReNeuron's therapy, coded ReN009, has shown it can stimulate the tissues of the foot to increase circulation, albeit so far just in rats.

Nonetheless this is a small company (£20m) with substantial risks. ReNeuron reported a loss for the full year ending in March of £3.7m, down from £6.6m the year before. It also reported cash of £0.9m. But this potentially blockbusting stock has so far managed to avoid most of the publicity heaped on its peers. That may not be the case for long.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how