Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

One winner of these Darwinian times will be global heavyweight Accenture. Its core activities are technology-based consulting (60% of sales) and IT outsourcing services (40%). The latter are typically being delivered under long-term contracts for large multinationals and government agencies.

Furthermore, it employs around 180,000 staff, operating in numerous sectors and geographical regions. This gives the firm a wide spread of activities and a fair dose of resilience in the face of a reduction in corporate IT budgets, a stronger dollar and more intense competition from rivals such as IBM, EDS and CSC.

Accenture's robustness was on display in the March quarterly results. Sure, they reflected the fact that many of its clients have been deferring projects and reducing spend wherever possible. Yet Accenture still managed to deliver a creditable 3% rise in revenues, a 12.9% operating profit margin and a bucketload of cash. It achieved all this thanks to a first-class brand, huge economies of scale and deep market expertise.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

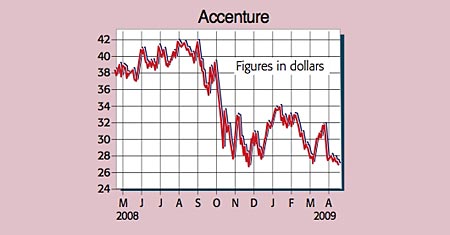

Accenture (NYSE:ACN), tipped as a BUY by Socit Gnrale

Overheads have also been slashed. As a result, the board is predicting like-for-like turnover of $23.5bn, underlying earnings per share (EPS) of $2.64 and $2.35bn of free cash flow for the year ending August 2009. This puts the stock on an attractive price-to-earnings (p/e) ratio of 10.4, with a 13.8% return on free cash flow.

But how much is Accenture worth? I value the group using an eight times earnings before interest, tax and amortisation (EBITA) multiple, which gives it a $20bn valuation. After adjusting for $3bn of net funds, I get a fair value of $37 per share, about 30% higher than the current price. What's more, the company has now teamed up with Cisco to offer state-of-the-art "cloud computing" services (see cover story on page 24), and should benefit from US President Barack Obama's plans to transform the antiquated American electricity system into an interconnected 21st-century smart grid.

Short term, things will remain sticky in its consulting division, especially if some of its cash-strapped financial and telecommunication clients are forced into bankruptcy. Nonetheless, with many of its smaller rivals (eg, Satyam) also suffering, I'd expect Accenture to grab more market share. British investors may suffer if sterling strengthens, but with an excellent franchise and attractive valuation, the stock is as a solid long-term buy.

Recommendation: BUY at $27.5

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson