Forget China's dairy boom here's a real bargain beverage

The Chinese are getting a taste for milk. And, while it may seem a good bet on first sight, high prices and unrealistic projections means there are better opportunities in other drinks. Cris Sholto-Heaton picks a promising, overlooked soy stock.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here.

Before we start, we've put together a useful free guide to foreign dealing. You can download this report here.

If you've ever popped into a grocery store or used a vending machine in Hong Kong, you may well be familiar with Vitasoy (HKG:0345). Soy-based drinks in flavours from jasmine to chocolate - are hugely popular there and Vitasoy is the Coca-Cola of the soy drinks market.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I've been thinking about Vitasoy lately because I was drinking some soy milk while reading a report on real milk. It was all about China and how consumers there are going crazy for milk after years of snubbing it.

The Chinese dairy business is certainly growing very quickly. And this has got investors excited - Chinese dairy firms are trading at some pretty racy multiples. But I think they've got it wrong. If you want to gain access to China's undeniably promising drinks market, I reckon you'd be better of with soy than the stuff that comes out of a cow.

Here's why

China's growing thirst for milk

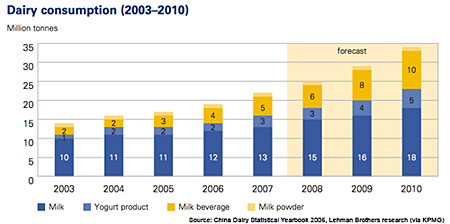

The Chinese milk story looks a good bet on first sight. China's dairy market is doing extremely well, as you can see from the chart below. Sales of dairy goods have grown at an average 13% a year, and are likely to keep doing so. Consumption levels remain low: at 42 grams a day in 2006 according to UN statistics, it's well below the Asian average of 140 grams, so there should still be plenty of room for growth.

The market is still very fragmented. Four large-ish firms China Mengniu Dairy, Inner Mongolia Yili Industrial, Shanghai Bright Dairy and Shijiazhuang Sanlu account for 40-45% of sales, with the rest coming from hundreds of small producers and distributors.

With no single big player dominating the market, price wars have been a constant feature in recent years, hitting profit margins. A major bout of mergers and takeovers looks likely, which will cut competition. Investors are betting that this, along with the strong sales growth in sales, will deliver bumper profits for many years to come, and they're pricing the sector's main players accordingly. Mengniu trades on a forecast price/earnings ratio of 24.5 times, Yili on 31.1 and Bright Dairy on 28.6.

But in their enthusiasm, investors may be missing a couple of things. Milk might be a novelty just now, but it's likely to become just a commodity in the long run after all, it's hard to think of a single high-profile milk brand in the developed world. Your average Chinese dairy is more likely to become a generic producer like Britain's Dairy Crest than a world-beating brand like Coca-Cola.

Perhaps more importantly, there's a snag with the sky-high projections for how big the dairy market could get. Up to 95% of the Chinese population has some degree of lactose intolerance. That means a fairly substantial number cannot drink milk at all, and many can only drink relatively little. Making your customer sick is not a great selling point - so chances are that consumption will top out a long way below Western levels.

There are better opportunities in other drinks

There are better ways than milk to play China's changing diet. Consider the soft drinks market, which has been growing just as fast as milk an average of 13% a year over the last ten years, according to drinks industry researchers Canadean.

Consumption rates remain low. At around 27 litres per person per year, it's about 20-25% of consumption in countries such as Japan, Hong Kong and Taiwan. That overstates the long-term potential a bit - as with milk, older, rural Chinese citizens often don't consume soft drinks and that's unlikely to change. But you don't have the problem of health issues putting off a big chunk of your target market.

Drinks companies are very excited about China. Firms like Coca-Cola and Pepsi are already major players and want to get bigger. This week Coke bid HK$12.20/ share US$2.3bn in total - for fruit juice maker Huiyuan. And if you thought dairy stocks were trading on steep multiples, that amounts to almost 50 times Huiyuan's forecast earnings for this year. Coke is clearly pretty confident.

You could buy into Coke, Pepsi, Danone or one of their local competitors. But my favourite option is Vitasoy. It's an overlooked stock that trades on much lower valuations than most of its sector, yet looks set for years of strong growth.

Fast growth beneath the surface

Vitasoy's signature soy milk products are extremely well-geared towards local tastes and it's an obvious alternative to dairy for the lactose intolerant. It's also a major producer of tofu also made from soy beans and has several smaller business such as bottled water, fruit juice and dairy products.

The firm has trading for almost 70 years and its brand in Hong Kong is extremely strong, as shown by the way sales bounced back rapidly after a contamination problem and major product recall in the late nineties. The goal now is to build the same recognition and loyalty in mainland China, through its "core brand, core business, core city" strategy, which means expanding gradually and investing heavily to build its reputation in each new market.

Headline sales at Vitasoy are respectable, but not stunning, as you can see from the table below. Looking at this, you would conclude that it's a strong business, but not a growth story on the lines of some Chinese drinks firms.

But the headline numbers disguise the true picture. The bulk of Vitasoy's sales still come from Hong Kong, which is slow-growing, followed by the equally mature North American market. Its growth markets are China and Australia/New Zealand, where the pace has been blistering, as you can see in this sales breakdown.

Because these markets are smaller than Hong Kong and North America, they have a muted effect on the overall business. But because they're growing so quickly, the impact is growing all the time. If they can continue with this pace, they will pull up the overall growth rate for the group. Of course, this depends on the firm managing to keep growing its market in the face of strong competition but so far, management seems to be executing its strategy very well.

The fact that the firm has such a solid, long-standing business in Hong Kong to back its expansion plans is a major plus. The situation is the US is more disappointing: despite some strong brands, the unit has been making a small loss for the last few years. However, the firm is now changing its strategy for the US and hopes to turn this around soon.

Great value at this price

Financially, the firm is in excellent shape - very important in these tough times. It has virtually no debt total debt-to-equity is just 8% and generates plenty of cash. It operates in a fairly defensive industry - sales continued growing through the last recession, although profits dropped off as the firm continued investing for the future rather than cutting back. This is an encouraging sign of a management that takes a long-term view, as you'd expect from a business that is still controlled and run by the children of the founder.

Meanwhile, the firm's valuation is very reasonable. On a foreward p/e ratio of 15.5 times, it trades well below almost every other firm that's trying to tap the Chinese drinks market. The regular dividend yield is a solid 3.2%, but that excludes a special dividend that has been paid for the last six years. Last year, this was 10HK/share, putting it on a total yield of 5.9%. Investors can't bank on always receiving this it might well be cut if the economy is struggling or the firm needs to use its free cash flow for investment but it shows that the firm wants to reward shareholders when times are good.

The main risks with this stock are that the Chinese drinks market doesn't develop as strongly as expected or that the firm is unable to deliver the growth we expect either because of tough competition or mistakes. The first seems unlikely. The second is always a risk with any company, especially one expanding into new markets. However, Vitasoy's strong performance so far, solid financials and strong core business give it a good chance of success.

This is not a company to buy if you looking for stocks that are likely to shoot up in the next few weeks. But since MoneyWeek Asia's focus is on long-term investment, few of the companies that we look at are. If you have the patience to hold a stock that's quite likely to stagnate between results, but has great growth prospects and pays a very solid dividend, Vitasoy looks like a good buy.

Vitasoy

Exchange: Hong Kong

Ticker: 345

Price: HK$3.62

Market cap: HK$3.67bn

An update on Ezra and the oil price

If you bought into oil services-provider Ezra Holdings after I mentioned it a fortnight ago, you'll have noticed that the stock has fallen almost 25% this week. There's no news from the company, nor is there any rumour that we're aware of: instead, this is almost certainly the result of the collapse in the price of oil over the last few weeks. You'll remember that we touched on weaker oil as a near-term price risk at the time.

Oil service providers around the world have been selling off heavily even the blue chips such as Schlumberger and Halliburton are off more than 10% and the Singapore-listed ones have been hit particularly hard: other firms such as Swiber and shipyards geared to the industry such as Sembcorp are also down heavily.

Unless you believe that oil is about to collapse to well below $60-$70/barrel and stay depressed for years to come, there's no logic behind this. Oil firms are making investment decisions on that kind of long-term price, not $150/barrel, so this oil price fall will likely have no impact at all on Ezra's earnings. That's especially obvious given that much of Ezra's fleet is already on long-term contracts.

If you've already bought into Ezra, I certainly wouldn't sell now, even though the price could dip lower in the near term as oil continues to head lower. Ezra is attractive as a long-term story and trying to trade in and out on long-term investments is a great way to raise your costs and reduce your returns.

Once the market realises that Ezra earnings won't collapse, the shares should come back strongly (as should other oil services providers). At the latest, I'd expect this to happen by the time it releases its full-year results in October.

How to buy foreign shares

Just before we go, at MoneyWeek we frequently get queries about how to buy foreign equities, such as the ones featured in MoneyWeek Asia. In fact, it's remarkably easy for UK investors to buy shares in many international markets, including Hong Kong and Singapore, but there isn't a great deal of information around on how to do it and which brokers to go to.

So we've put together a free guide to foreign dealing and a list of brokers that trade these markets. These are available for download here: Foreign dealing guide / Broker list

Turning to the markets

Asian stocks fell along with the rest of the world, as last week's optimism about global growth prospects vanished. Airlines were one of the few bright spots, thanks to falling oil prices, while commodity stocks dropped sharply. In Hong Kong, China-focused property developer Chinese Overseas Land and Investments was the worst performing stock in the Hang Seng with a drop of almost 14% on the week, after statistics showed residential property sales dropped 6.6% year-on-year in July.

Political uncertainty is also damaging several markets. In Japan, prime minister Yasuo Fukuda unexpectedly resigned after plans to boost the economy which slid into recession in the second quarter were criticised as inadequate. In Malaysia, opposition leader Anwar Ibrahim defeated the ruling-party candidate by wider-than-expected margin in a by-election. The government has been under pressure and in disarray since a strong opposition showing in the March elections saw its majority fall below two-thirds for the first time since independence. Anwar has problems of his own; he is set to go on trial for sodomy (a crime in Malaysia) charges that he claims are politically-motivated.

Meanwhile in Thailand, the struggle between the government and the People's Alliance for Democracy movement which wants to replace parliament with appointed representatives spilled over into violence on the streets of Bangkok. In an effort to defuse the crisis, prime minister Samak Sundaravej announced plans for a referendum on whether the government should step down, as the protesters demand. Given his party's support in rural areas he could probably win this vote, but his support in political circles is faltering, with his foreign minister resigning on Wednesday, and it's unclear whether he will survive long enough for it to take place. Most analysts expect fresh elections within the next few months.

In the currency markets, the renminbi has been holding fairly steady against the US dollar for several weeks and now stands around 6.84 RMB/USD. Traders have drastically cut bets on how far the currency will rise in the near future; just a few weeks ago the forwards market was pricing in a rise to 6.4 by this time next year, but now virtually no appreciation is expected. However, with the dollar rebounding strongly against the euro in recent weeks, the renminbi is up around 9% against the euro since the start of July, making Chinese exports more expensive in Europe and potentially piling more pressure on Chinese exporters already hit by slowing global demand.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

One million more pensioners set to pay income tax in 2031 – how to lower your bill

One million more pensioners set to pay income tax in 2031 – how to lower your billHundreds of thousands of pensioners will be dragged into paying income tax due to an ongoing freeze to tax bands, forecasts suggest

-

Stock market circuit breaker: Why did Korean shares pause trading?

Stock market circuit breaker: Why did Korean shares pause trading?The fallout from the conflict in the Middle East hit the Korean stock market on 4 March, with shares forced to temporarily stop trading. What is a stock market circuit breaker, and why did the KOSPI trigger one?