Buy this safe stock exchange

Not so long ago, listed stock exchanges were booming. But investors have on average lost 70% of their capital on them in the past few years. Theo Casey looks at this fast-evolving sector, and finds that one market in particular now offers a very tempting entry point.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A few years ago, listed stock exchanges were booming. But investors have on average lost some 70% of their capital in the past few years. One market in particular now offers a great entry point. But which is it?

Before diving in, you need to know what you're buying. Markets are very fragmented and keep on evolving as the greybeards of the industry are challenged by younger, faster rivals. This is especially true in Europe for the likes of the 209-year-old London Stock Exchange (LSE). Take Vodafone. From 28 June to 2 July only 31% of the 1.67 billion Vodafone shares that changed hands were traded via its primary market, the LSE. The rest were traded on other exchanges, or in off-exchange, 'over-the-counter' markets (sometimes known as 'dark pools'), according to data provider Fidessa.

The LSE has tried to counter this trend by buying Turquoise Trading (a prominent dark pool) from a consortium of banks. However, this platform is not doing particularly well. For example, Turquoise managed to capture just 3% of the trades in Vodafone shares mentioned above.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It's a similar story elsewhere in Europe. The Frankfurt-based Deutsche Brse has also lost market share to dark pools in recent years. To make matters worse, Deutsche recently reported sharply lower net profits due to paltry derivatives trading on its Eurex and ISE platforms.

Emerging-market exchanges have fared better as investors have sought exposure to the Bric economies. But they carry other risks. The region's best bet is Brazil's BM&F Bovespa, the Brazilian securities, commodities and futures exchange. The Sao Paolo firm is already the third-biggest exchange in the world by market cap. This is due partly to growth, but is also a result of consolidation it's now the only exchange in the country. Better still, the regulatory framework is sophisticated for an emerging market. But there's a problem.

In the past five years, Brazil has become very popular for overseas investors. And when those investors are hit in their home market, they tend to sell foreign holdings to raise funds. Inflows and outflows of this 'hot money' create huge volatility. And the exchange trades on 24-times earnings hardly cheap. Look further north and you'll find some US exchanges that are cheaper and keeping pace with the industry.

The derivatives exchanges the Chicago Board of Trade (CBOE) and Chicago Metals Exchange (CME) in particular are enjoying a purple patch. CME Group, for example, is an innovative alliance formed between three of the biggest US exchanges the New York Mercantile Exchange (Nymex), the CBOT and the CME. It's now the world's largest futures exchange. Sadly, CME stock (NASDAQ: CME) isn't cheap at 21-times next year's earnings. And if US politicians rein in bank risk taking, volumes will suffer.

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

That's why the CBOE (Nasdaq: CBOE) is the more interesting bet. Its shares jumped 12% following an over-subscribed 16 June initial public offering (IPO). But it's yet to see the post-IPO tumble that so many firms suffer. That's because it may well become takeover bait. After all, many rivals have seen big mergers and acquisition activity in recent years. So the CBOE the world's largest equity options dealer, valued at just $3.3bn may not be independent for long. As such, it could be worth a punt for risk takers. As Barron's notes, Wall Street expects a deal within 18 months. We also look at a safer bet in the box below.

The best bet in the sector

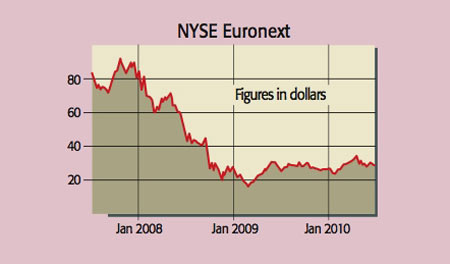

At first glance the NYSE Euronext (NYSE:NYX) exchange looks a tad boring. It's the sector's largest company the combined market cap of the companies listed on the exchange is a massive $25trn and trades at a reasonable 11 times earnings. The yield is 4.4%.

But for a big exchange, NYSE is surprisingly nimble. It now makes about 50% of its revenue in Europe, following the merger with derivatives dealer Euronext. Indeed, an increasing volume of sales comes from derivatives the US stock trading business (most at risk from dark-pool competitors) accounted for just 10% of revenue and 5% of profits last year. It also makes 16% of its revenue from data a growth market for NYSE. The group hopes to take this $400m revenue to $1bn by 2015 by allowing high-speed traders to take advantage of new data centres in London and New Jersey.

And it has cut costs ruthlessly. The NYSE and Euronext once boasted a 5,000-man workforce, costing $2.25bn a year. That has been trimmed to 3,000 and $1.8bn. NYSE may even be a suitor for the CBOE. So this is one incumbent stock exchange that doesn't rest on its laurels and is available at what could prove to be a bargain price.

This article was originally published in MoneyWeek magazine issue number 494 on 9 July 2010, and was available exclusively to magazine subscribers. To read more articles like this, ensure you don't miss a thing, and get instant access to all our premium content, subscribe to MoneyWeek magazine now and get your first three issues free.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Theo is a former financial writer and editor, having written for reputable titles such as Euromoney Institutional Investor and Redwood Publishing. He has also appeared on-screen with Al Jazeera, BBC and CNBC and on MoneyWeek Theo covered funds, share tips and stockmarkets. He also edited the country's oldest newsletter with Lord Rees-Mogg for four years. Theo now runs his own content marketing agency for financial companies, and he is a seasoned CISI-qualified investment adviser.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify