Shares in focus: Wolseley plumbs new markets

The distributer of plumbing and heating products is in great shape. So should you buy shares in Wolseley? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wolseley is in great shape, but is fully valued. So stick it on your watchlist, says Phil Oakley.

The business

Wolseley is the largest trade distributor of plumbing and heating products. It also supplies building materials. It makes money by acting as a middleman between around 100,000 product sellers and about one million regular customers. Most of these are in the housebuilding and construction trade.

Around 60% of its sales are related to repairs and maintenance rather than new construction. It sells products from 3,600 branches in 23 countries, trading under names such as Plumb Center in Britain and Ferguson in America. Wolseley had sales of £13.2bn in the year to July 2012.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The history

The business can trace its roots back to 1887 when Frank Wolseley set up a sheep-shearing machine company in Sydney, Australia. During the 1890s the company moved to England and started making cars. It then moved into heating, pipes and distribution a similar business to the Wolseley of today.

The 1950s saw it merge with Geo H Hughes, a Birmingham-based business that made wheels for prams and industrial users. The 1960s saw an expansion into oil burners and boilers, followed by industrial pipe valves and fittings during the 1970s.

The company then started to grow rapidly, which provided the platform to enter the American market during the 1980s, when it bought Ferguson Enterprises, a plumbing and supplies business. Wolseley continued to buy more American businesses during the 1990s and also started buying companies in Europe.

During the early 2000s profits soared on the back of booming housing markets, but so did the company's debts as it continued to spend lots of money buying companies.

By 2008, Wolseley was in trouble as the US housing market had collapsed. Profits fell and Wolseley was forced to ask its shareholders for £1bn of new money. The business is now on an even keel again. Lots of under-performing businesses have been sold and profits are on an upwards trend.

The chief executive

Ian Meakins has been chief executive since 2009. Before joining Wolseley, he was chief executive at Travelex, the foreign-exchange business, and Alliance Unichem. Brought in to sort out the mess that Wolseley got itself in, by most accounts Meakins has done a good job. He was paid £2m last year.

Should you buy the shares? Wolseley operates in very tough markets. The housebuilding sector remains very depressed in most countries, particularly in Europe. The outlook in North America where Wolseley gets just over half of its sales is starting to improve after a long period in the doldrums. But competition remains intense, which makes it difficult to grow profit margins.

So for now Wolseley has become a self-help story; costs are being pared back as it tries to do more with less. There has also been a big focus on improving cash flow. This strategy has proved fruitful to the extent that Wolseley was debt free at the end of July.

That won't last for long, though, as the company's pension fund needs topping up and it has decided to pay a £325m special dividend. That said, the company's finances should not worry investors.

The key question is: where is the profit growth going to come from? We don't think new house building markets will come roaring back to the levels of activity seen a few years ago. However, since the plumbing and heating distributor market remains very fragmented, Wolseley will look to keep making bolt-on purchases of businesses from its surplus cash resources. There are more efficiency gains to come too and its struggling French business is likely to be sold.

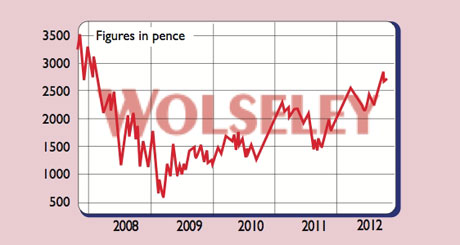

All in all then, Wolseley looks to be in very good shape and is making good returns on its assets. The only problem is that its share price largely reflects this, having gone up by nearly 60% during the last year. So we wouldn't dive in now. Stick Wolseley on your watchlist instead.

The numbers

Stockmarket code: WOS

Share price: 2,670p

Market cap: £7.7bn

Net assets (July 2012): £3.1bn

Net cash (July 2012): £45m

P/e (current year estimate): 14.8 times

Yield (prospective): 2.6%

What the analysts say

Buy:10

Hold: 15

Sell: 0

Average price target: 2,850p

Directors' shareholdings

I Meakins (CEO): 84,410

J Martin (FD): 21,071

G Davis (chairman): 13,038

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Iran conflict: What are your rights if you’ve got travel insurance?

Iran conflict: What are your rights if you’ve got travel insurance?US involvement in Iran and the consequent fallout across the Middle East has caused chaos to many people’s travel plans – we reveal your rights if you’re impacted.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.

-

Now the bitcoin bubble’s burst, what’s the next big thing?

Now the bitcoin bubble’s burst, what’s the next big thing?Features Forget bitcoin, if you want to increase your wealth faster than most other people, you need to find the next big thing. Merryn Somerset Webb suggests some places to look.