Timber can withstand ill economic winds

Timber is the ultimate crisis-friendly investment: if you don't like the look of prevailing prices, just leave the trees to grow. And right now, timber is relatively undervalued, says Eoin Gleeson. Here, he examines the sector and finds out the best way to invest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

"This is the most positive housing report in ages," crowed Patrick Newport of market analysts IHS Global Insight. He was referring to news that sales of single family homes in the US leapt 11% in June analysts had expected just 2.3%. Stocks in housebuilders surged as the news lit a fire under Wall Street.

No sector had been more impatient for this news than timber companies. The collapse in home construction has been devastating for much of the industry, with planks piling up in mills as homebuilders went to the wall. And with no furniture companies calling in orders, pulp mills across northwest America have been abandoned.

Shame this isn't the revival they've been waiting for. Most of the demand for new houses is coming from first-time buyers, says Gerry Shih in The New York Times. And that is largely thanks to Barack Obama's temporary 10% tax credit on the purchase price of a home. That credit expires on 1 December. Any uptick in housing demand will die with it.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The futures market seems to agree. Futures traders paid little or no heed to the housing starts numbers with lumber prices falling to a four-month low the same day they were announced. That's because it's the foreclosure rates that really matter, says RBC Capital Market analyst Paul Quinn.

Those numbers are dire. About one in every 16 homes is foreclosed in Arizona. The rate for California is one in 34. And with a huge backlog of houses already on the market about 9.4 months worth of supply there is very little sign of demand picking up for lumber and logging groups.

That's not true of everyone in the industry though. Forestry groups have been able to rest easy during this recession. The beauty of owning a forest is that if you don't like the look of prevailing timber prices, you can just leave the timber to grow on the stump.

And the longer you leave the trees to grow, the more valuable they become. For around the first 15 years a pine tree, for example, is good for cheap pulp. But after 20-27 years it is useful for telephone poles or plywood, and fetches far more.

That's why timber has such a great record of performance during recessions rising during three out of the four big ones this last century. That seems to have been forgotten by investors pushing up the price of more exciting stocks over the past five months. Timber is relatively undervalued along with other defensive stocks. Yet it is the ultimate crisis-friendly investment.

Forestry groups have certainly been busy buying up trees from Asia to Latin America. China is trying foster forest plantations of its own after Russia, its main exporter, decided to raise taxes on exported Russian logs.

Meanwhile eucalyptus plantations are springing up across Uruguay and Brazil as they open up to private forestry groups. The trees may be harvested after six years for burning as biofuel. Or they can be left to grow for 20 years for use as sawtimber.

Overall, Latin pulp capacity will grow by nearly 40% between now and 2015, accounting for nearly 35% of the global market, says Kurt Akers of Global Forest Partners. Below, we have a look at the best ways to benefit from investing in timber.

The best bets in the sector

Many investors play timber by stocking up on the Claymore and S&P Global Timber index exchange-traded funds. But both carry too much exposure to paper, wood manufacturing and distribution. We prefer single stocks such as Canadian forestry group Sino-Forest (TSE: TRE). The firm owns vast tracts of forest in China and has little debt on its books. It is up 32% since we tipped it at Christmas.

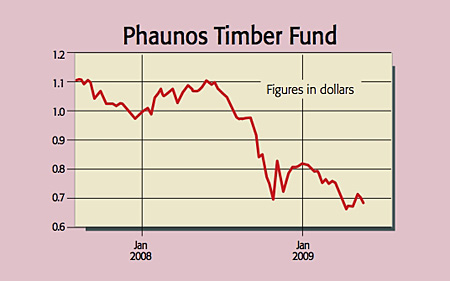

UK listed timber fund Phaunos Timber (LSE: PTF) looks even better value. Phaunos is a Guernsey-based, closed-end investment company and owns forests in 13 countries. These range from teak plantations in Brazil to poplar farms in Oregon. It had invested $150m by the turn of the year, but it still had about $400m in cash.

Recently, Phaunos has been very busy picking up land in South America including a $21m commitment in Uruguay. The fund charges an annual fee of 1.5% and trades at $0.68, down 16% since we tipped it at Christmas. At a 45% discount to its net asset value of $0.99, it looks good to us.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?