Profit from the 'bull market in fear'

The market has become a much less predictable place than we've been used to for the past few years. But this mounting volatility also presents opportunities for those who don't mind taking some risks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"Get used to volatility. Get used to short-termism," says John Waples in The Sunday Times. His point is that the market has become a much less predictable place than we've been used to for the past few years and it's likely to stay that way for the forseeable future. And you don't have to look far to see what he's talking about. Kate Brennan in Fortune magazine notes that during the last six months of 2007, the Dow Jones posted 100+ point swings 55 times against just 23 for the first half.

Many investors would understandably rather wait out this kind of turmoil in the safety of a cash deposit account. But this mounting volatility also presents opportunities for those who don't mind taking some risks. Do be warned, though: you can make or lose money pretty fast using these methods, so don't bet the roof over your head.

Options on the CBOE Vix index

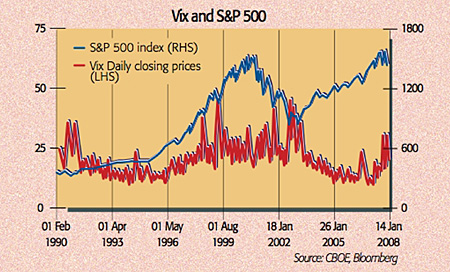

Capturing rapidly changing market sentiment isn't easy, but the Chicago Board Options Exchange comes close with its Vix "fear gauge". This reflects rising and falling levels of the so-called implied volatility priced into US S&P 500 equity options, but you don't need to get into the technical aspects to be able to play the index. As a rule of thumb, you buy stocks when the Vix is high, because moments of heightened fear tend to coincide with low stock prices and vice versa (see chart).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The recent overall trend, as you might expect, has been upward. The 2007 average was 17, compared to 13 in 2006. Since the start of this year the average has crept up to 27. Roughly speaking, this means that options traders see scope for a 27% movement in the S&P 500 over a 12-month period.

So how can you take advantage of this "bull market in fear"? Brennan tips Vix call options. As with other options, you pay a non-refundable premium for the right to "buy" the index at a pre-determined level by a set date. The higher the index then climbs above your chosen strike price, the more you make. (Conversely, a "vix put" makes money the further the index falls below the chosen "strike" level.) The plus side of options is that you can only lose your fixed premium if a bet goes wrong.

Just now, the Vix is at around 20. September and October are traditionally pretty volatile for equities. Given that we are gripped by what Gerald Corrigan, former president of the Federal Bank of New York, describes as "the most challenging financial crisis in the entire post-war period", it's hard to disagree with Ben Londergan in Barron's when he says that "a lot of people, including myself, think the Vix is too low right now". He tips "September 25 calls" a good bet if the Vix rises far enough beyond the 25 "strike price" to cover your premium. Brokers offering trading in Vix options include Charles Schwab (www.schwab.com), with a charge of $8.95 fixed commission plus 75 cents per contract to buy and sell, and Ameritrade (www.tdameritrade.com).

Spreadbets

An alternative is to place a bet directly on share prices either individually or as a group. So, for example, rather than betting on a rising Vix, you could bet instead on falling share prices either here or in America. For example, a spreadbetter could "sell" the resources and financials-heavy FTSE 100 at £10 per point at 5,442 when the quoted spread is 5,442-5,444. If the index then falls and the revised spread is quoted as 5,422-5,424, the same bet can be closed or bought back for 5,424, to bag a profit of 20 points or £200 (less dealing commissions). An upfront "stop loss" chosen above 5,442 would increase the cost of this down-bet slightly, but also cap your maximum loss should the index rise rather than fall. IG Index (www.igindex.co.uk) or Capital Spreads (www.capitalspreads.com) are two of the many brokers offering spreadbets.

Inverse and leveraged ETFs

An increasing number of exchange-traded funds (ETFs) offer plays on volatility by either magnifying the impact of a change ("leveraged" ETFs), or rising as the index falls and vice versa ("inverse" ETFs). Combine the two features, "inverse leveraged", and you get a product that, for example, rises 2% for every 1% fall in an index. For exposure to drops in the S&P 500 (the latest dire American housing and banking statistics look sure to keep the recent rally based largely on falling commodity prices pretty short) there's the inverse 2x S&P Select Sector Financial ETF (AMEX:RFN). Closer to home there's the DBx-trackers FTSE 100 short (LSE:XUKX), and with the German economy now in trouble it contracted by 1% in the second quarter the DBx-trackers short DAX (LSE:XSDX) is worth a look too.

Hedge funds

For a sounder night's sleep, you could let a hedge-fund manager take the risks for you. Unlike many conventional "long-only" funds, hedge funds regularly take both leveraged and short positions, although this is reflected in higher fees. Unfortunately, access for private investors is largely limited to listed "funds of funds". Tim Price of PFP Wealth Management tips BH Macro (BHMG), a FTSE 250 fund, which is up around 14% since the start of the year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how