This one mistake will sabotage your trades

Our subconscious drives can sometimes lead us into making bad trades, says John C Burford. That's when tramlines come in handy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last Wednesday, I watched an interesting programme on TV and I don't often say that. It was an investigation into the placebo effect. I have long been interested in this effect and how a sugar pill can often produce better health outcomes than a supposed wonder drug. I suppose it appeals to my contrary nature.

Most placebo experiments have centred on the test patients and the doctors not knowing which pill was which the classic double-blind study. But in the experiment on the programme I watched, both patients and doctors knew in advance which pill they were using drug or sugar (actually, it is usually corn starch). And the amazing result was that patients still did better with the placebo.

You're probably wondering what this has to do with trading. Just about everything, as it happens. Although it appears perverse that a harmless inert pill can work wonders, it is not so strange when you consider the important role our attitudes plays in shaping our lives. If you and the doctor truly believe the placebo will work, chances are it will.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In the trading arena, pessimism will lead you to expect your performance to be sub-par, even if you are not conscious of it. If you are an optimist, you will expect the opposite.

So, before I follow up on Monday's post about the gold market, I will tell you how to use my tramline methods to avoid subconsciously sabotaging your trades.

Don't be your own worst enemy

There are many ways a trader can sabotage their trading. Here are some:

1. Taking profits too soon and holding losers too long.

2. Seeing a great entry and not taking it, fearing the worst.

3. Trading too large positions (over-confidence).

4. Not using protective stops (over-confidence).

These traits are difficult to correct without some aids to discipline. That is why I have incorporated easy-to-follow rules in my tramline trading method.

A. My 3% rule and break-even rule will help avoid 1.

B. Using resting stop-entry orders can help with 2.

C. My 3% rule helps you work out the maximum size bets for 3.

D. The most vital habit is entering your stop at the same time as your trade entry.

Whether these are placebos or not, they do work.

Was I right about gold?

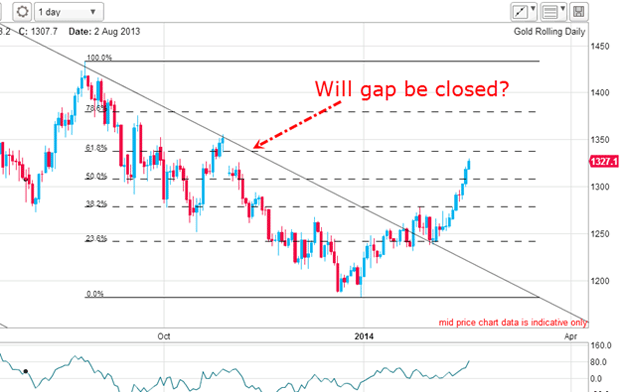

This is what I wrote: "There is a very large open gap from November, which was when the market broke suddenly. I have written about gaps previously and the one takeaway from a study of gaps is that most of them eventually get filled.

"Gaps act like magnets on a rod of iron. They attract the market back to it and when it gets close it suddenly reverses polarity, thereby repelling the market.

"My best guess this morning is that the market will close (or partially close) the gap, then suffer a dip before moving on towards my targets."

So let's find out how my guess is working out:

The market has moved inside the gap to the $1,230 level and is currently backing off, as I expected. Also, note that the rally has carried to the important Fibonacci 23% retrace of the wave down off the October high around $1,800. This is a natural place to at least see a slowdown in the rally.

This means I have two valid reasons to suspect a decent pause in the rally.

How do I play the pause?

If I was without a position and bullish, it would probably be best to wait for a dip to enter the gold market.

We have seen a rally, but it is tiny in comparison to the slide since October. And this rally seems to me to be either an A wave up or wave 1 of a five-wave pattern. Either way, the next move should be a small wave down.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets