The Dow Jones reaches my target

Predicting which way the market will move isn't enough, says John C Burford. You should always have an exit strategy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

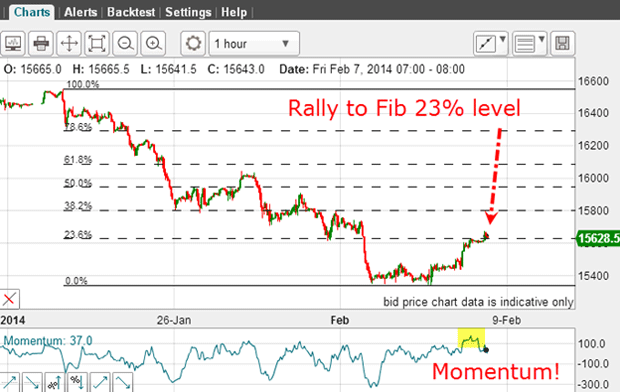

One of the miracles of trading aids is the Fibonacci tool, which is available on your trading platform. Few of my charts do not display the Fibonacci levels. I find them instrumental for showing me the levels where counter-trend moves are likely to reverse.

When I have this invaluable information, I can plan my exit from a trade well in advance. And if I'm not already in a trade, I can use them to plan a low-risk entry. That's because the Fibonacci levels allow me to set my protective stop close to the level I have focused on.

This enables me to use my 3% rule and work out my maximum bet size in a disciplined way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I find that while many traders will line up a trade with due regard to the profit potential, they often disregard the risk in entering at their chosen spot. But neglecting this risk can result in entering trades at the wrong time. And that can lead to big losses.

Plan your exit before you place the trade

If you jump into a trade impulsively with no stop, or a wide one, as you chase the market, a loss on it could devastate you (and your account). That's why an excellent attitude for any trader is to be humble and assume your next trade will be a loser.

It sounds crazy, and it goes against most of what we are taught in the 'how to succeed' self-help books. But it helps keep your feet on the ground. After all, there is no place for wishful thinking in the trading arena.

So the Fibonacci levels can act as a disciplinary tool and we all need those!

Is it time to take profits on my long trade?

I was looking for a pause at the 23% Fibonacci level and then a rally to the 38% level. But the market didn't pause there and just took off following the US employment report. Still, I wasn't unhappy with this turn of events, because I was long.

On Friday, I wrote: "Of course, the market may love the data and rally further, thereby aiding my long trade. So it's a win-win for me."

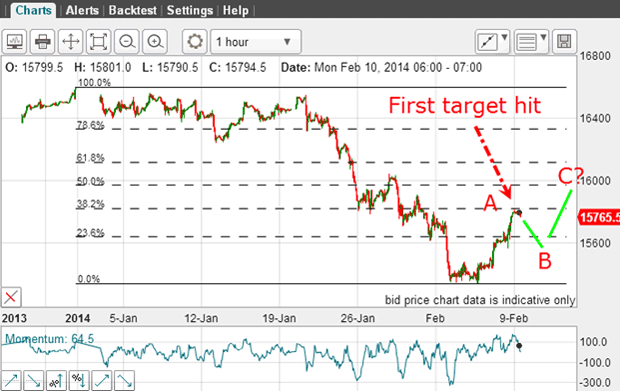

But with the rally to my 38% target, is this my A wave high? Here is the chart as of this morning:

Now I have to slightly re-draw my best guess' scenario: the wave A ends around current levels, then dips to the B wave low and then rallies again to my C wave high. That C wave high could reach the 50% level near 16,000 within a few days.

Does this mean I can safely take the profit on my long trade here? Or can I reverse my position and go short, looking for a good-sized dip in the B wave? Perhaps I can just hold my long position and raise my protective stop to break-even.

Today, I'm going to leave you with an exercise: what would your decision be?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets