Here's a Russell 2,000 index trade alert

John C Burford analyses the charts to set up an excellent trading opportunity in America's Russell 2,000 index.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

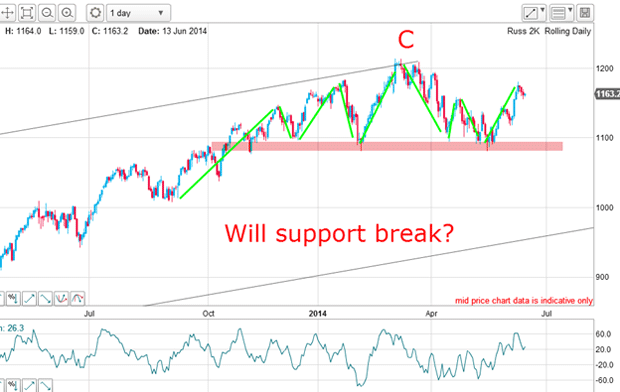

On Wednesday, I outlined my case for believing stocks markets are closer to a major high than they are to the start of a major bull market (as many pundits proclaim). I illustrated this on the charts of the Russell 2,000 index.

The Russell 2,000 all-time high was made on 4 March, while the Dow's high was made on 9 June over three months later. For three months, the small caps have been diverging from the large caps. That is why I call this a fractured market.

In a healthy market, the tide of liquidity would lift all boats more or less together. In this unhealthy market, some boats have taken on too much water and are sinking!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Why tramline kisses are so important

The noteworthy feature is the Chinese hat an area of extra-strong resistance. In fact, the force of selling was so strong there that the market soon broke through the lower tramline, thus changing the outlook for the immediate trend as being down.

I also noted the position on Wednesday morning, where the market had rallied to kiss the underside of the lower tramline in pure textbook fashion.

A tramline kiss is a very important event. If you have a reliable tramline, then a break and kiss can often set up a superb low-risk trade entry.

In fact, it is one of my favourite trade set-ups.

Has the main trend changed?

But first, let's examine the context for the kiss. The rally to the early March high into the Chinese hat occurred on a negative-momentum divergence, providing another clue that the next move would be down. Then, the move down from the Chinese hat is in five motive waves (marked in green). This is a vital clue that the trend has now changed.

The market then proceeded to break my lower tramline, which on Wednesday I established was a reliable line of support. With the break, it now becomes a line of resistance.

From the mid-May low, the market rallied in a normal advance to the underside of the just-broken tramline and has just planted a nice kiss on it.

Note that this rally is in a clear three-wave A-B-C form. This pattern is always counter-trend and thus confirms the trend is now down.

Also, the kiss was turned at the meeting of the Fibonacci 78% level and the tramline in a deep retracement. This is also a level of strong resistance.

The evidence is piling up that the main trend has now changed.

My roadmap for the market

And here is the C wave top:

If the pattern is repeated, we should see a move down to support, and if it breaks, we will have a head and shoulders (H&S) top with the support line providing the neckline.

One of the characteristics of an H&S top is that we can apply a very simple measuring rule for the minimum move. The rule states that at a minimum, the distance travelled after the neckline break is equal to the height of the head above the neckline.

A glance at the above chart would place that target roughly at the lower tramline (as occurred at the B wave low!). Isn't that convenient?

Not only do I have a roadmap for the market, but also a minimum price target. That is all a trading system can give you but it's enough!

This is an excellent trade opportunity

But at least, the kiss gave me an opportunity to position for an anticipated scalded-cat bounce and at low risk. And once I see that scalded-cat bounce develop, I can be more confident that my analysis is correct and lower prices beckon.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now