My last Dow trade was a loser – and I’m happy

Your trading system shouldn't just be about bringing in profits, says John C Burford - it should also protect you against heavy losses.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

You may be thinking: Is this guy nuts? He has taken a loss and he's happy?

The reality of trading in the real world is that everyone takes losses. There is no such thing as a risk-free trade. That applies to buying gold, shares, houses, art, and even unmade beds ( la Emin). Losses are inevitable in life.

We must take a view on market direction when we trade and sometimes we get it wrong. There is no shame in this.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But what separates the amateurs from the pros is that the latter can emerge from a losing trade with a minor loss, while the amateur may not be so disciplined.

The smart trading policy is to make sure your losses are as small as possible and that is what I achieved with my Dow trade, as I will explain today.

Proof that I can trust my Fibonacci levels

I had two alternate scenarios mapped out. Either the market would decline immediately or it would push through the Fibonacci resistance and move onto at least the next 78% level.

This was my scenario number one on the hourly:

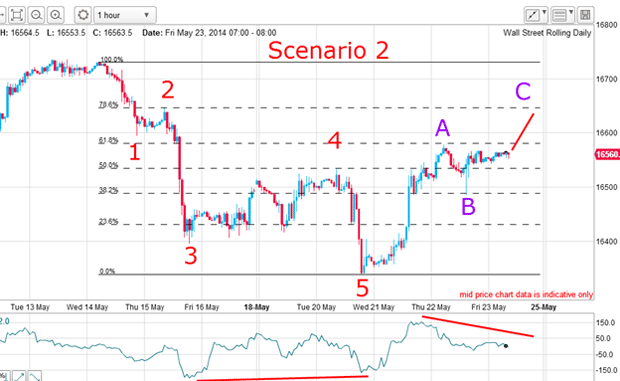

And this was my alternate scenario:

I had established a short position near the A wave high based upon my Elliott wave labels. I had a nice five waves down (new down trend) off the 14 May high and the 62% retrace of that wave down was a very common termination point for relief rallies. A short trade was a high probability one.

Because the market made a direct hit on the Fibonacci 62% level and bounced down, this was obviously an important level for the market and allowed me to enter a very close protective stop just above this level. In fact, my stop was placed only 20 pips away.

Normally, such a close stop would be guaranteed to be picked off simply by market noise alone, and would be a suicidal policy. But because I can trust my Fibonacci levels to within a few pips, this stop made a lot of sense.

In fact, the market did decline by almost 100 pips off this level to the B wave low, confirming the 62% level as a level of some resistance. But that was it for the downside and the market rallied once more to approach the 62% level again, which is where I left it on Friday.

And yesterday, the market blasted right through the 62% level and my stop was hit.

Why I'm happy to take a loss

My protective stop at 16,585 was hit and I took my loss.

Consider what would happen if I traded without a stop. The market is trading close to the 16,700 level as I write. My entry was at 16,565 and this means a potential loss of 135 pips.

If I was trading at the minimum £1 per pip, that is a potential loss of $1,350 (roughly £800). Even if this represents 3% of my account and following my 3% rule, then my account needs to be at least £27,000 for that loss to be within the 3% rule.

So, I hope you see why I am happy taking a 20-pip loss. It allows me to retain almost all of my trading capital and I can fight another day virtually unscathed. My next trade may be a winner. Also, I do not have to be in the market all the time a fact that many traders do not realise.

You can't avoid losses but you can keep them small

This is the daily chart:

I have drawn the upper line off the 2007 high that has been a major line of resistance for these seven years. It should be respected. Remember, the longer a line of support or resistance has been in place, the more reliable it will continue to be. And seven years is a very long time. Respect it!

There is a lovely wedge taking shape and momentum is showing a large-scale divergence with price. The buying pressure is weakening and that means a reversal very likely lies up ahead. But where will it appear?

My final target is around my upper line and that lies in the 16,800 region. We are only 100 pips away, so the high can arrive at any time. My view is that when the final high is in place, the move down will be historic.

Because an overshoot of a resistance line indicates a buying exhaustion, it would be fitting if one appeared in the next few days. And because I suffered only a small loss on my last trade, I have plenty of ammunition left to fire at my next trade.

What is a winning attitude? Expect losses and keep them tiny. The winners will take care of themselves.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King