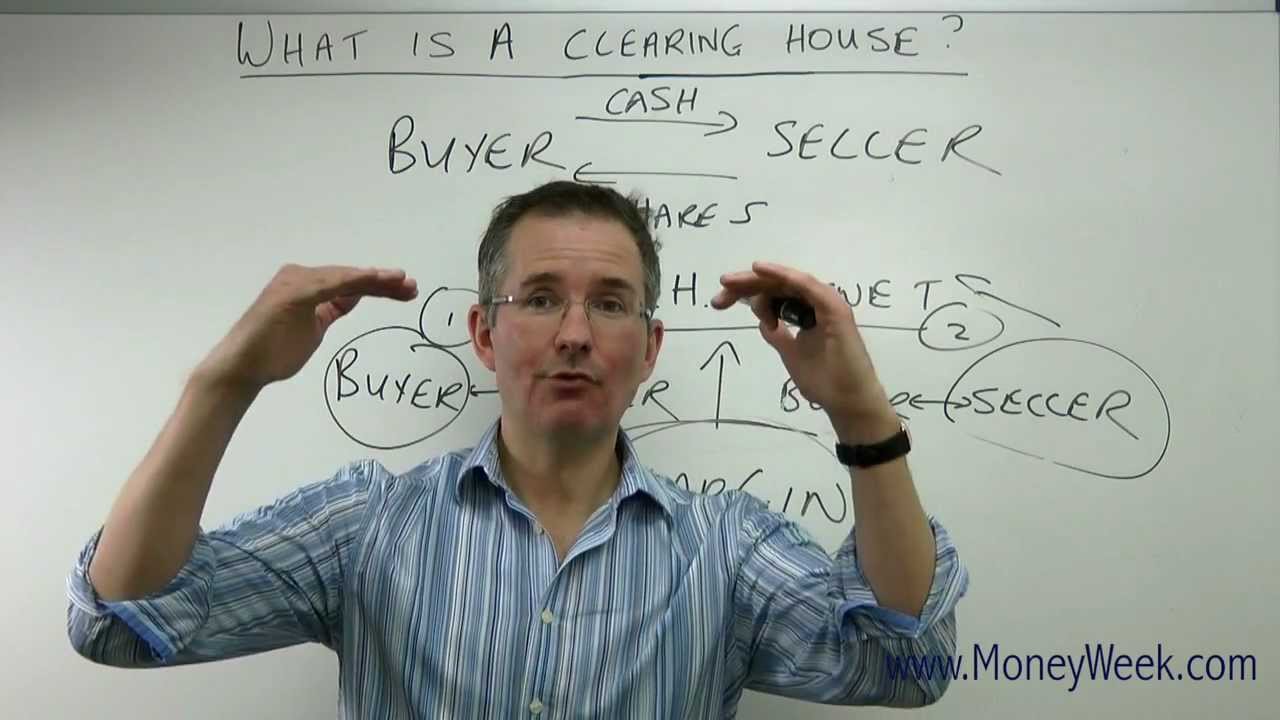

What is a clearing house?

Clearing houses play in important role in the financial markets. But what exactly are they and what do they do? Tim Bennett explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Clearing houses play in important role in the financial markets. But what exactly are they and what do they do? Tim Bennett explains.

Related videos

What investment banks actually do

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Should we 'ring-fence' the banks?

Why does Starbucks pay so little tax?

In this video: three little tricks companies can employ to minimise their tax bills.

None of these companies have been accused of doing anything illegal, avoiding tax is about negotiating with HMRC and reducing the amount of tax you pay.

If you want to pay a little bit of tax, you need to declare low profits.

If you're talking to investors a company, you tell them about all the profit you're making. If you're taking to Inland Revenue, you tell them you've made little profit, so they can't charge lots of tax. Reducing profits means reducing charges from the taxman.

This is about corporation tax, which is different to taxing people. Starbucks pays other taxes in the UK, it employs around 5,000 people so it has to pay National Insurance contributions, and it pays business rates, and so on. One or two journalists have got it completely wrong, you do not pay corporation tax on sales, only on profits.

The three tricks to paying little tax:

Profit is your sales revenue minus your costs.

How do you do this?

- Debt agreementYou could get head office to fund your UK operation. Head office would then pump debt into the UK business to get it started, and then you pay interest back to head office. The great thing about borrowing money from another company in your group, is that the worldwide finance director sets the rate. So you could set the rate at a level that starts to absorb some of the profits that the UK operation is making.Tax authorities reserve the right to keep rates sensible, but there is an opportunity to reduce UK profits so that the company isn't hit for too much UK corporation tax.

- Royalty agreementsThere is a brand, a loyalty and licensing agreement. Not just anyone could set up a Starbucks stand.Starbucks can stick its licensing agreement to use its brand name etc, globally, in a country that pays very low tax, such as Holland. If the royalty agreement is held somewhere with low tax, you then charge places like the UK to make and sell Starbucks coffee under the Starbucks brand.If you set a rate of 6% of the sales figure per year for the UK to use the Starbucks brand, there's another way to reduce the UK's profits. They have to send 6% of their sales to the Dutch operation, all owned by Starbucks globally, in order to make and sell Starbucks coffee. Reuters estimate that in 2011 Starbucks made £636million of UK sales. 6% of that is roughly £37million, so that's a way of reducing profits.Why a 6% rate? It's got to be something which you can negotiate with the tax people. 20%, they'd say is ridiculous. Starbucks would say 6% Is about right, that's what they think it's justifiably worth.

- Past losses:If you set up a business in the UK and lose money as you're trying to grow it because you spend a lot on marketing etc. getting it set up, the loss that you make can be carried forward to tax purposes. Bluntly: imagine in 2010, for tax purposes, you make a loss of £50million, because your trading is not profitable, and in 2011 you turn things around and make a taxable profit of £50million. Under the tax rules you can net the two off against each other, carry that forward into 2012 to give an overall tax bill for both 2010 and 2011 at £0.

- A debt agreement

- Royalty agreements

- Past losses

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

By Kalpana Fitzpatrick Published

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

By Imran Sattar Published