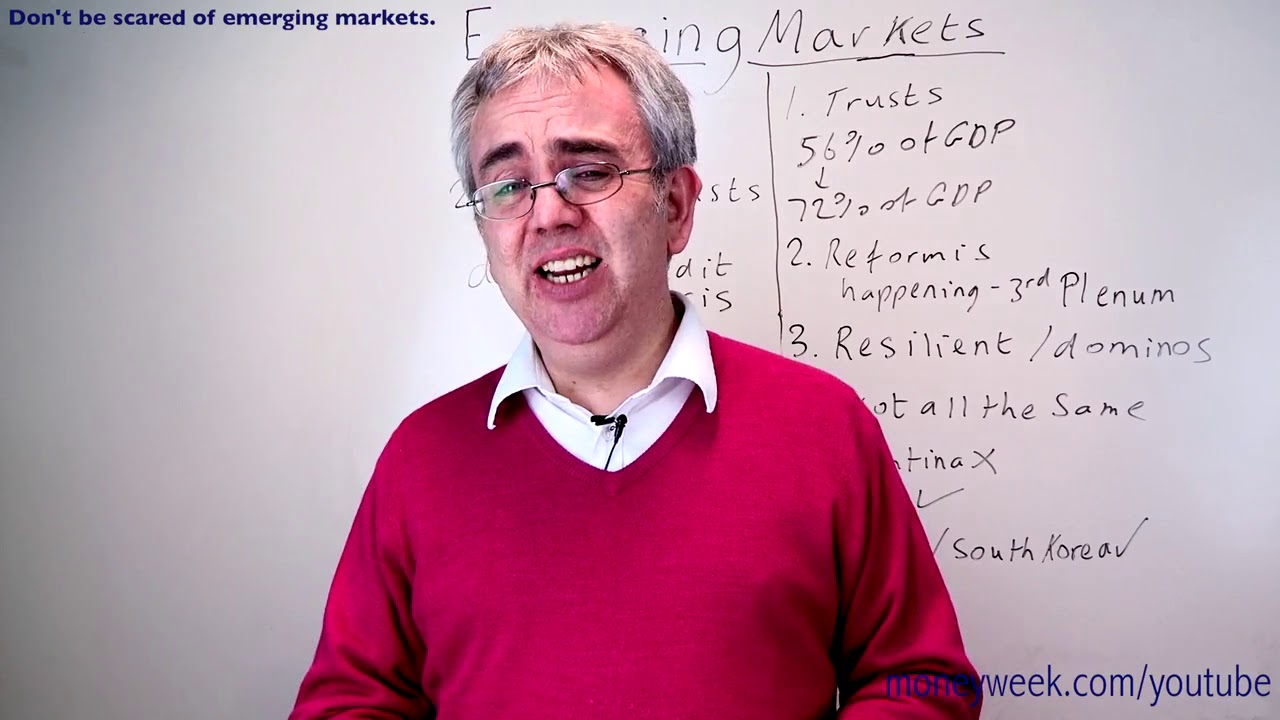

Don’t be scared of emerging markets

Fears over emerging markets are probably overdone, and now looks to be a good time to invest for the long-term. Ed Bowsher picks the best places to put your money.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Emerging markets have had a difficult fortnight. Markets are worried about the US taper and what might happen in China.But these fears are probably overdone and now is probably a good time to invest in the likes of China and Mexico for the long-term. Granted, the risks are high, but right now, the risk/reward structure is in your favour.

So just quickly, what is an emerging market? There are loads of emerging economies across the world. They're countries that have traditionally been poor, but have been growing more quickly in the last 15 years or so, and have plenty of potential for big growth in the future.

You may have noticed that in the last couple of weeks we've had significant share price and bond price falls in emerging markets, and those falling prices have triggered a mini panic or a wobble that's spread over into the US and elsewhere, where we've seen share prices falling.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So what's triggered this mini panic? There are actually several reasons, but I'm just going to focus on the two most important.

The first is the taper. We looked at the taper last week in a video called What is the taper?But basically, it's the idea that the US Federal Reserve is beginning to slow down its money printing programme. That means it's going to buy fewer US government bonds, so bond yields will rise.

The theory is that if bond yields are rising, US bonds become a more attractive investment, and some investors will want to pull their money out of China, India, Russia, wherever else, and back to the US.

So we've had more talk about the taper in the last couple of weeks that's triggered this little wobble. There'll be more tapering going on over the next year or so - we may see further similar wobbles as that process goes on.

The second big trigger for this wobble has been problems with an investment trust in China that's been marketed by ICBC.

Just to be clear, a Chinese investment trust is a very different beast from a British investment trust. It's really more like a high-interest savings account, where lenders and savers lend money to Chinese businesses. These are marketed through a bank.

What's happened is that there's a danger that one of these trusts may default, so the savers may all lose their money. That's increased the panic, because many people have been worried for some time that there's potential for a credit crisis in China.

Arguably, we've even had too much growth in China over the last decade, and there's been too much credit and too much borrowing. The ingredients are there for a credit crisis similar to what we saw in the developed world in 2008. So when people hear about a trust defaulting that's somehow linked to a bank, that gets people worried; people think China may be coming to a big financial crunch.

Now, my view is that China probably isn't coming to a big financial crunch, that the emerging markets are quite resilient now, and now is a good time to invest. When people are scared is often the best time to invest in a market.

And now's a good time to invest in emerging markets. And here are my reasons why you shouldn't be so worried. Let's look at the trusts first.

Even if all of these Chinese investment trusts defaulted, and the Chinese government bailed out all those trusts, Chinese government debt, as a%age of GDP, would rise from 56% to 72%. That's a big rise. It would create a loss of confidence, and cause problems, but in the long-term the Chinese government could cope with that rise in debt. It wouldn't be a mega crisis. And anyway, not all of these investment trusts are going to default. Maybe only one trust is going to default, or two or three trusts.

The Chinese government is very much aware of this problem; it's been aware of it for a while. That's why it's trying to move these investment trusts away from the Chinese banks towards the mutual fund industry, and that way players across the Chinese economy - borrowers and lenders and savers - should have a better understanding of what the risks involved are. That's the best outcome.

I also really like China, because I think China now is reforming. The Chinese government gets it; that became very clear at a party meeting called the Third Plenum' last November, when all sorts of new reform measures were announced. I've spoken to a lot of people about this; I do think the Chinese government is sincere, and the more structural reform the Chinese government does, the more resilient its economy will be, and the better the economy can cope if any financial problems do come through.

I think there's an issue with resilience across the emerging markets. When we've seen previous emerging markets crises, particularly in the late 90s, one or two countries had problems, then quite a lot of other countries would quickly have problems too, and you'd see a sort of row of dominoes collapsing.

Emerging markets now are much bigger, they have less debt, and they're more differentiated, so I think they're more resilient. If you have a big crisis in one country, say Argentina or Turkey, that doesn't mean it's going to bring down all the other emerging markets with it. To put it another way, not all emerging markets are the same. Some look like really attractive investments; some don't.

I wouldn't go near Argentina. It's got problems with its currency, its government is too left-wing, and it's not pushing through real structural reform. But I like China for the reasons I've just said. They're serious about reform.

I also like Mexico. It's near the US - that's a great place geographically to be; great potential if you want to export manufactured goods. The government is ending a monopoly of a state-owned oil company, so we should expect to see a big increase in oil production in Mexico in the long-term.

South Korea, I really like. It's actually much more advanced than most other emerging markets. It's got global companies like Hyundai and Samsung, yet its stock market's trading on an average price earnings ratio of 11. That looks like a really sexy, interesting market. And apart from geopolitical concerns with North Korea, it looks very well-placed to do well.

So, emerging markets to me are an attractive investment at the moment. Of course, there's risk. It's riskier than your average investment in shares, but I think now's a good time to do it, when people are scared and the risk-reward ratio is in your favour.

If you're tempted to invest, and you want to do a sort of more general, across the board investment, take a look at the Templeton Emerging Markets Investment Trust. It invests across a lot of investment trusts. It's got a very good manager, a chap called Mark Mobius. It's 27% invested in China and Hong Kong. That's a great one for a long-term investment.

If you want to focus more just on China, go for the JPMorgan Chinese Investment Trust. Again, another trust with a good record. The charges aren't too high and you can get some good exposure to China.

So, hopefully I've convinced you that emerging markets are at the very least worth considering. I'll be back with another video next week. Until then, good luck with your investing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.

By Kalpana Fitzpatrick Published

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

By Laura Miller Published