What is 'profit'?

Tim Bennett explains the various ways profits can be measured, and what each one means.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Tim Bennett explains the various ways profits can be measured, and what each one means.

What is "profit"?

The trick is to realise there are four or five ways a firm can make a "profit", it's important as an investor to know which is which.

A profit and loss account appears in the financial statement, in front of the balance sheet and the cash flow statement.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

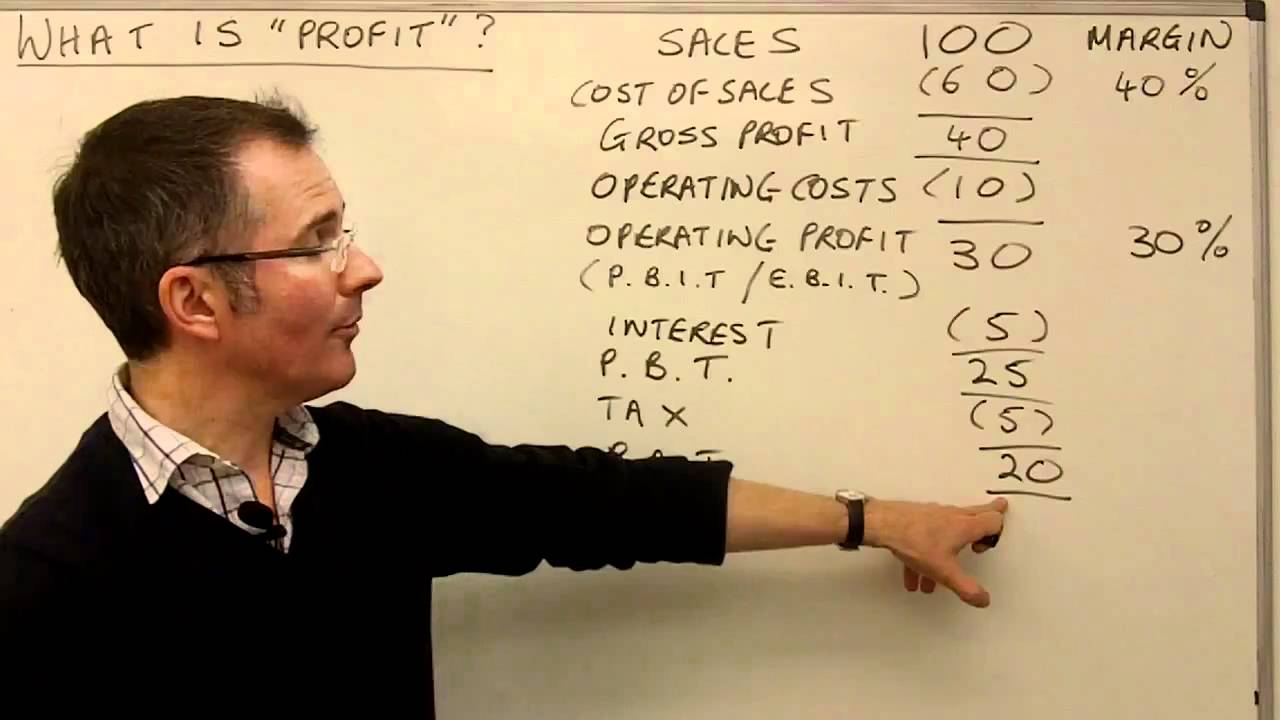

The following is an example using figurative numbers.

The first figure in the profit and loss account, at the top, is sales/turnover. Say sales = £100.

Next, cost of sales: the direct cost of making sales, the costs that vary with sales = £60.This leaves the balance at £40. This is called the gross profit.

Gross profit: the profit the company makes from sales minus the direct cost of sales.

Sometimes people talk about the gross margin, and they'll give a percentage.In this case, the gross margin is the gross profit over sales. So 40/100 = 40%.Quite a nice profit.

However, there's a lot missing: overhead, staff costs, bills, etc. Those come in as what some accountants call "overheads", I'll call them operating costs.

Let's make those £10. Gross profit is now £30, this figure is called an operating profit.The operating profit over the sales gives the operating profit margin: 30%.

Overheads are important, you can't ignore them, so a lot of analysts think the operating margin is a better number.

Analysts and commentators use different words for the same number. Eg: P.B.I.T. (profits before interest and tax) and E.B.I.T. (earnings before interest and tax). They mean the operating margin.

Interest chargers: the business may have outstanding loans, say £5. Bringing the total down to £25. Before tax: this is known as P.B.T. (profit before tax).

Tax: the rate depends on how big the company is, let's say it's £5. Bringing the total down to £20. After tax: this figure is known as P.A.T (profit after tax). This is the profit figure that's used in earnings per share calculations. This becomes the NET profit: it's after virtually all costs, at 20%.

Earnings per share calculation: take the earnings for the year (£20) divided by the number of shares in issue, and that would give the earnings per share number.

Dividends: directors know over the last 12 months they've made a profit of £20, after direct, indirect costs, interest, and tax. They might want to share this out. How much they pay out and how much they keep back and retain in the business is up to the directors.

Say they give out half, so £10, the remaining is called the retained profits - the amount kept back in the business to be invested or future years.

Investors would see that directors are paying out half the profit after tax as dividends, so in that case, the so-called pay-out ratio, (the amount that's paid out in a dividend) is half or 50%.

If you are an income investor looking for an income, this is important; you want a firm that pays out a decent proportion of its profits each year.

So when people talk about profit, are they talking about:

- Gross margin

- Operating profit margin

- The E.B.I.T. or P.B.I.T. margin

- Or the net figure, after interest and tax

E.B.I.T.D.A. earnings before interest and tax before depreciation and amortisation. These are costs buried in the operating costs that affect the wearing out of a company's assets.

If I buy a delivery van as a company, and I think I can make sales from it for 10 years before it breaks, I might choose to write off 1/10th or its original cost each year through the profit and loss account.

I wouldn't do this in year one, because it can still generate sales in the next nine years. So accountants like this idea of matching costs and revenues, they prefer if you divide its costs over ten years and charge each year's profits for the 10th of the cost of the van. This is known as depreciation.

When you do it to an intangible asset such as a brand name, it's called and amortisation charge. Some think this is a bit dodgy.

Analysts prefer to have the operating profit figure, E.B.I.T., stated before depreciation and amortisation, in other words they add back the amount they think the company has charged for depreciation and amortisation.

This becomes a more reliable profit figure'. It's closer to something cash-based; there are fewer subjective dubious charges included; it's before you worry about tax policy, and interest on debt, neither of which are to do with the business, it just reflects the decision the director made to take out the loan in the first place.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

By Dan McEvoy Published

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

By Laura Miller Published