Stocks are climbing that ever-higher “wall of worry”

There is no shortage of worrying global developments that would induce a trader to run for the hills, says John C Burford. But what are the charts saying?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It can hardly be denied that stocks are climbing that infamous "wall of worry". Every day it seems, more and more doom-laden headlines appear in the media to suggest stocks are heading for an almighty fall. That is making my "headline indicator" (HI) start to twitch (as it has done recently for crude oil and gold).

On Thursday afternoon, Mario Draghi unleashed his latest money-printing bazooka, and I made a few comments on Friday on how that related to the euro. Since then, there has been a veritable barrage of negative comment from the pundits on why central banks are out of ammo. Many conclude that the next crisis will see them powerless to stem the inevitable wave of selling.

Here is a small flavour:

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"Do negative rates mean central banks are out of bullets?"

"Interest rates another ominous signal for the markets".

"Draghi deals more drugs, but investors not buying".

"Love affair with negative rates ends as central banks step back from global currency wars".

My take on the consensus view in the media is that the high regard that central bankers enjoyed until recently is being rapidly eroded. They have been seen as all-knowing, all-powerful instruments of stockmarket gains, having offered investors first the "Bernanke put" and now the "Yellen put".

But now it is common to read very negative and sometimes vitriolic press on their activities.

Long-time readers of mine will recognise this development as one I have been forecasting for some time, starting in Ben Bernanke's era at the US Federal Reserve. I have been suggesting that the reputation of the Fed and other central banks would collapse this year.

But that is not the only source of worry, by any means. There is the massive immigrant influx into Europe and the potential for unseating Angela Merkel next year in Germany with a rise in hard-line anti-immigrant parties. There is also the well-known slowdown in China, the commodity rout, and the US company earnings downturn.

It seems that the "wall of worry" is getting even higher than Donald Trump's proposed fence on the Mexican border.

So is my HI giving a contrary warning that instead of a looming crash, an extension to the rally is more likely in the near term?

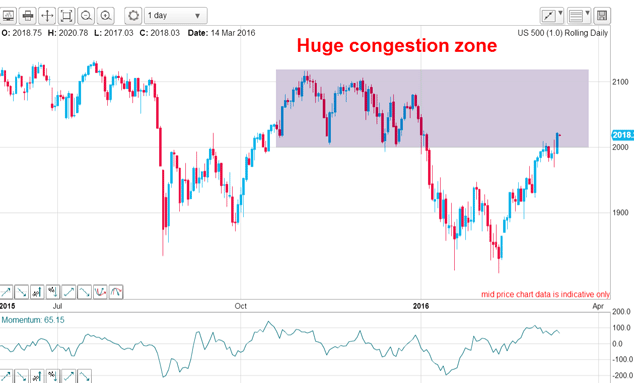

Here is the daily chart of the S&P 500:

The rally off the February low has been truly outstanding, with only a few down (red) days, while on green (up) days the daily gains have been huge. That is a very strong market.

Note that last month, the press was uniformly bearish, with HI well into negative territory. The build-up of speculative short bets was the fuel for this rally in a terrific short squeeze.

Yes, there is no shortage of worrying global developments that would induce a trader/investor to run for the hills. But what are the charts saying?

Belowis the S&P 500 showing the rally off the recent lows is now entering the large congestion zone formed by the indecisive trading in the latter part of last year.

Usually, when a market has entered such a solid zone of potential resistance, the rally either gets turned back for good or makes a series of zig-zag waves as it ploughs through it on its way to higher levels.

Naturally, if the latter scenario plays out and the market makes it to the upper boundary of the congestion zone, any poke above it will encounter masses of buy stops placed there by the shorts. That would almost certainly ensure a further gain and a strong likelihood of new all-time highs being seen above the 2,100 area.

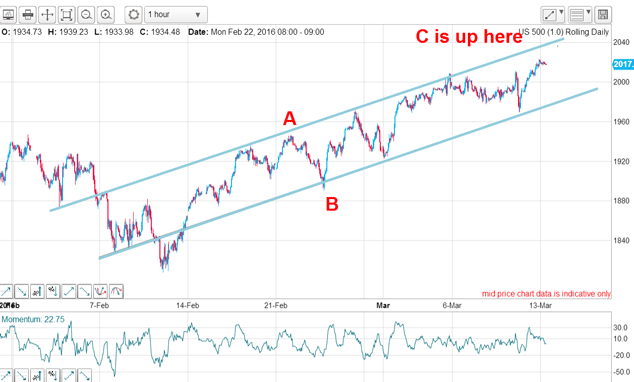

So the market is entering a critical phase. Here is the hourly chart of recent action:

The rally is following my tramlines with an excellent upper resistance line. That line has held all rally attempts since mid-February. The lower support line is not so reliable, but it does contain several accurate touch points (the "Draghi plunge" low on Thursday was one of them). The market is currently working back up towards the upper tramline with the trend still up.

To my eyes, the entire rally has the appearance of an A-B-C, which is counter-trend. And we are in the final stages of wave C under this scenario.

Summing up, it appears likely the market is at or near the end of the current rally and if so, should decline to test the lower tramline soon.

But after that?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.